How to recertify for B Corp: Deadlines, pathways and what’s next

How to recertify for B Corp: Deadlines, pathways and what’s next

“Scope and complexity have shifted, but CSRD reporting is not going away. Having ‘no regret’ actions ensures a strategic approach to ESG.”

Setting the scene: The Omnibus shift and CSRD

Our recent webinar explored the EU Omnibus simplification package and its impact on CSRD reporting and wider ESG strategy. The focus was on understanding who is now in scope, how timelines have shifted, and what this means for both mandatory CSRD implementation and voluntary ESG reporting.

While the Omnibus has narrowed CSRD scope and adjusted the CSRD timeline, it has not removed the underlying regulatory and stakeholder pressure for high‑quality ESG and CSRD reporting. Instead, it has created a clearer differentiation between organisations in scope of CSRD and those that will move towards voluntary standards such as VSME or the soon-to-be developed voluntary standards for non-CSRD companies, and Global Reporting Initiative (GRI).

Download our reporting guide to understand the ESG reporting frameworks, relevant for your organisation!

Legislative process and the Omnibus package

Four parallel legislative tracks

The session summarised how the sustainability Omnibus package has evolved since the initial CSRD adoption in 2021. Four parallel legislative tracks were highlighted:

- Omnibus I (“Stop the clock” directive): Paused CSRD application for waves 2 and 3, providing time to address contentious issues such as CSRD scope and reporting content.

- Omnibus content proposal: Introduced new thresholds and exemptions for both CSRD and CSDDD, clarifying which organisations are mandated to publish a CSRD report.

- Revised ESRS: Exposure drafts from EFRAG aim to simplify disclosures, including a reduction of around 60% in data points and confirmation that assurance remains at a limited level for now.

- EU Taxonomy delegated act: Adjusted to align scope and application with CSRD changes, introduced financial materiality thresholds for non‑material economic activities, and simplified DNSH criteria.

Updated thresholds and CSRD scope

A key outcome of the Omnibus is the substantial increase in CSRD reporting thresholds.

CSRD:

- EU undertakings: CSRD now applies to entities exceeding 1,000 employees and EUR 450 million net turnover, assessed both at entity level and on a consolidated basis for EU parent undertakings.

- Non‑EU undertakings with significant EU presence: Where a third‑country parent generates at least EUR 450 million EU turnover for two consecutive years and at least one EU subsidiary or branch individually exceeds EUR 200 million turnover.

CSDDD: Thresholds increased to 5,000 employees and EUR 1.5 billion turnover, clearly targeting very large groups.

CSRD scope, exemptions and consolidation

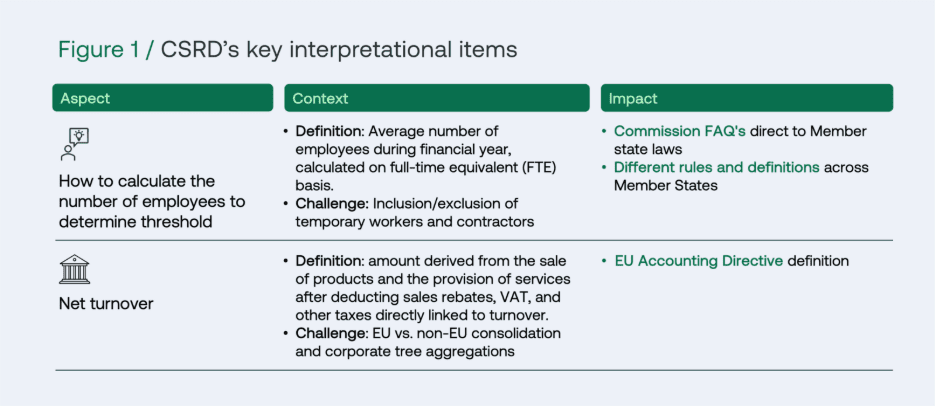

Key interpretational items: Employees and turnover

Interpreting CSRD scope is less straightforward than the headline thresholds suggest. The employee criterion is defined as the average number of employees during the financial year, calculated on a full‑time equivalent (FTE) basis. This raises practical questions around temporary workers, contractors and part‑time staff.

Companies often struggle to calculate this consistently across Member States, particularly where national rules differ. Organisations are advised to reconcile definitions with the EU Accounting Directive and their financial statements. Similarly, net turnover must be carefully consolidated to determine whether thresholds are met at entity and group level.

Omnibus reporting exemptions

Two new exemptions introduced by the Omnibus play an important role in CSRD scope and consolidation:

- Group composition changes: Parent undertakings may omit specific information where the group has changed significantly due to mergers, acquisitions or divestments, provided they disclose the events and their impact on impacts, risks and opportunities (IROs).

- Financial holding undertakings: with subsidiaries having business models and operations independent from one another and whose sole purpose is to hold investments may choose not to report.

Both exemptions require transparent disclosure and do not remove the need to fully understand CSRD scope across the corporate structure.

Consolidation scenarios and CSRD implications

Our experts have gone through practical case-by-case examples and scenarios to illustrate the complexities of determining CSRD applicability under three different scenarios:

- EU-based holdings with cross-border consolidation

- Non-EU holdings with significan EU presence and how consolidation might look like for large non-EU groups.

- Financial holding structures and exemptions in a real-life situation

To dive deeper into example scenarios, watch our on-demand session!

How businesses should respond: In scope and beyond

CSRD journey for in‑scope companies

For organisations in scope of CSRD ESRS, a staged implementation journey aligned with the revised timeline is essential:

- By 2026: Completion or update of double materiality assessments, ESRS gap analyses, and initial climate transition and decarbonisation plans.

- Foundations: Policies, actions, targets and metrics (PATM), EU Taxonomy eligibility assessments, and climate risk analyses where ESRS E1 is material.

From financial year 2027, systems and tools must be ready for CSRD data collection, with reporting in 2028 subject to limited assurance and digital tagging.

ESG strategy for companies outside CSRD scope

For organisations not in scope, the focus shifts from compliance to strategic ESG positioning. Double materiality assessments remain highly valuable for ESG strategy, even without mandatory CSRD reporting.

Recommended actions include:

- Mapping regulatory preparedness and stakeholder expectations

- Conducting a benchmarking exercise to define a minimum compliance baseline and ESG ambition

- Considering voluntary reporting aligned with VSME or GRI

- Developing a clear ESG roadmap linked to impact and investment

Q&A highlights: Key participant questions

Are small suppliers affected by CSRD requirements?

Small suppliers are not directly subject to CSRD, but larger customers may request sustainability data. Clients should not request information beyond voluntary standards such as VSME. Aligning reporting with VSME or GRI provides a practical response.

How do consolidation rules apply where subsidiaries do not meet thresholds individually?

CSRD scope must be assessed at each consolidation level. Where consolidated thresholds are exceeded, a parent entity reports on behalf of the group, exempting subsidiaries from separate CSRD reports.

How are mergers and acquisitions treated under CSRD?

Significant events include any changes materially affecting IROs, such as mergers, acquisitions or divestments. These must be transparently disclosed where exemptions are applied.

How strict are customer data requests towards non‑CSRD companies?

Customers should not require data beyond voluntary standards. Suppliers aligned with VSME or GRI are better positioned to respond efficiently.

Does the Omnibus reduce the strategic importance of sustainability?

No. The Omnibus reinforces the strategic focus on business model and double materiality, encouraging a top‑down, strategy‑driven approach to ESG reporting.

Watch our session for more questions answered!

How Nexio Projects can support your reporting journey

Nexio Projects supports organisations across their ESG and CSRD reporting journey, combining regulatory expertise with hands‑on implementation experience.

Key services include:

- CSRD and ESRS‑aligned reporting and implementation roadmaps

- VSME‑ and GRI‑aligned voluntary ESG reporting

- Emissions reporting (e.g. SB 253) & reduction

- Climate risk assessments (e.g. SB 621, ESRS E1)

- Decarbonisation action plans and science‑based targets

- Ratings and certifications support (EcoVadis, B Corp etc.)

The objective goes beyond CSRD compliance, to using ESG and double materiality as drivers of strategic value creation and risk management.

Next steps: Take action on CSRD and ESG

If you’re interested in taking the next steps, book a free con sultation with our experts now. Discuss CSRD implementation, scope assessments, double materiality reporting or ESG strategy tailored to your organisation.

Additionally, you can subscribe to the monthly newsletter to stay informed on CSRD & ESRS developments, timeline updates and ESG reporting insights.