CSRD updates: Timelines, legislative process, and what’s next

CSRD updates: Timelines, legislative process, and what’s next

“Climate risk creates direct financial risk. Understanding and managing it is essential for resilient business strategy.”

Climate change has evolved from an environmental issue into a profound financial reality, directly impacting operations, supply chains, assets, and market access. Businesses that recognise climate risk as financial risk position themselves for resilience, while those that hesitate face escalating costs and vulnerabilities. Proactive management of climate-related risks now defines competitive advantage.

Climate risk refers to the potential direct and indirect financial, operational, social, and environmental effects that arise from a changing climate and the global transition to a low-carbon economy. Climate-related risks are now recognised by investors, regulators, and boards as systemic, shaping everything from credit ratings to supply chain strategy.

The economic effects of climate change are already prevalent: studies estimate that, on a business-as-usual pathway, climate damages could shave up to 17% off global GDP by mid-century (1), driven by hits to infrastructure, productivity, agriculture, and public health. This is not an abstract future scenario; it is a trajectory that will directly affect asset values and corporate performance within current planning horizons.

Understanding climate risk

Physical risks

Physical climate risks stem from the impacts of climate change itself, including both acute and chronic hazards. Acute risks include extreme events such as floods, storms, wildfires, and heatwaves that can shut down facilities, damage assets, and interrupt logistics. Chronic risks include gradual shifts such as rising temperatures, changing precipitation patterns, and sea-level rise that can undermine asset productivity, strain infrastructure, and slowly erode margins (2).

Real-world events already illustrate the scale of these impacts: wildfires, floods, and prolonged droughts have caused hundreds of billions in economic losses, disrupting utilities, transport, telecommunications, and manufacturing across entire regions. These losses demonstrate how conducting climate risk assessments is no longer optional for organisations with long-lived assets or global supply chains.

Transition risks

Transition risks arise from the global shift towards a low-carbon, climate-resilient economy. These include policy and regulatory changes (covered in the later section: The regulatory landscape), market and technology shifts, and reputational pressures. Examples range from carbon pricing and emissions caps to changing consumer preferences, new low-carbon technologies, and litigation linked to inadequate management of climate risk (2).

As climate regulations tighten, companies may face higher operating costs, stranded assets, or sudden shifts in demand if they are not prepared. Transition risks can also materialise through supply chain fragility, where suppliers fail to adapt to new standards or technologies.

Why climate risk is financial risk

Climate risk translates directly into financial outcomes through multiple channels. Physical events can destroy assets, halt production, and create costly downtime; transition dynamics can alter revenue streams, capital costs, and market access. The challenges of climate change therefore sit in between finance, risk, legal / compliance and strategy teams, not just sustainability departments.

Forward-looking companies increasingly use scenario analysis to test how different climate futures, such as 1.5°C, 2°C, or higher-warming pathways, could affect their business models and investment decisions. This exercise is as much about resilience and opportunity as it is about avoiding losses. Customers are increasingly asking for proof rather than promises. Conducting a climate risk assessment gives companies a deeper understanding and a clear baseline from which to develop and respond to related customer expectations, such as decarbonisation strategies, credible transition plans, science-based or other emissions-reduction targets, transparent reporting, and product carbon footprint disclosures.

Read more about setting science-based targets for emission reductions.

These dynamics are especially pronounced in sectors such as chemicals, FMCG, and other resource- and energy-intensive industries, where scrutiny of climate risk is rapidly intensifying beyond regional regulation to include sector-specific expectations across value chains. For companies operating in these sectors, climate risk is increasingly shaping competitiveness, cost structures, access to capital, and long-term strategic positioning.

The business impact around the world

Example #1: Wildfires and economic cascades

Wildfires in Los Angeles generated $250-275 billion in economic losses across utilities, telecommunications, manufacturing, and travel sectors, demonstrating how one physical event cascades through interconnected economies (2).

Example #2: Supply chain disruption from weather

Droughts reduced hydropower capacity by 20% in key regions, halting production for major manufacturers and creating ripple effects across global supply chains, underscoring vulnerability beyond direct operations (2).

Example #3: Infrastructure and operational continuity

Floods in Germany inflicted $1.4 billion in damage to Deutsche Bahn’s infrastructure, disrupting transport networks, commuter services, and regional economies while generating reputational fallout (3).

How to be prepared?

- Operational continuity: Organisations that understand and plan for physical climate risks are better able to maintain operations, reroute logistics, and protect critical assets when disruptions occur.

- Insurance and risk transfer: Insurers are increasingly wary of climate-exposed assets, raising premiums or withdrawing cover. Companies that can show robust climate risk consulting support, mitigation plans, and adaptation measures are more likely to secure coverage on favourable terms.

- Access to capital: Banks and investors now systematically integrate climate risk into lending and investment decisions. Businesses with credible climate risk assessment and transparent disclosure under frameworks such as TCFD reporting and IFRS S2 are viewed as lower-risk, improving their access to capital.

- Reputation and market position: Customers, employees, and partners increasingly favour organisations that manage climate-related risks responsibly, seeing this as a proxy for overall governance quality and long-term viability.

In short, businesses that are prepared for the challenges of climate change are better positioned to weather volatility and capture emerging opportunities in low-carbon markets.

The regulatory landscape

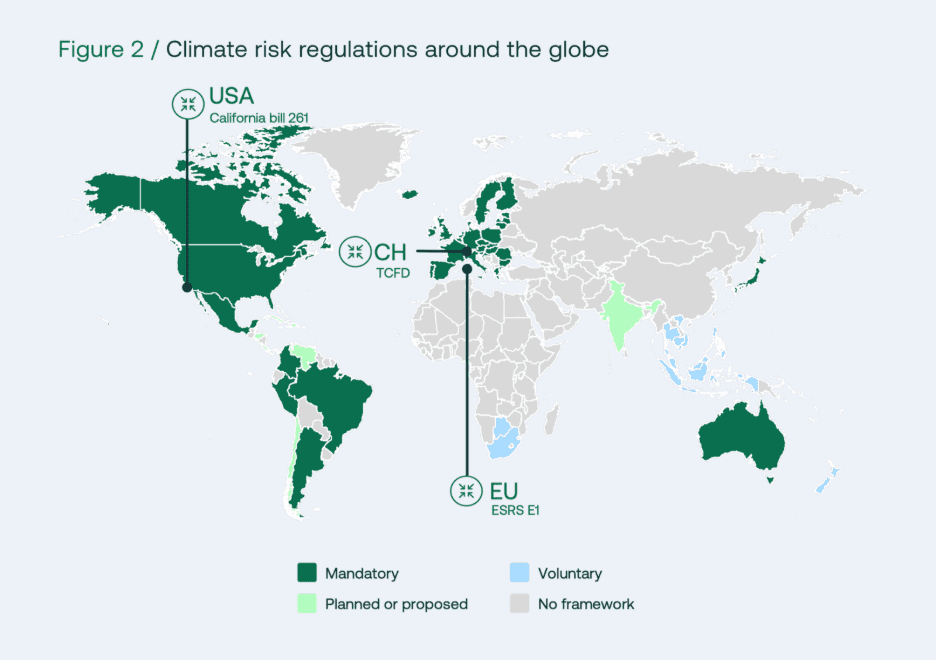

Regulators worldwide are transforming climate risk from a voluntary concern into mandatory financial reporting, creating both compliance imperatives and strategic opportunities for prepared businesses.

TCFD: The global foundation

The Task Force on Climate-related Financial Disclosures (TCFD) provides the foundational framework—governance, strategy, risk management, metrics & targets—now underpinning mandatory regulations worldwide.

CSRD & ESRS: EU requirements

The EU’s Corporate Sustainability Reporting Directive mandates climate risk analysis and adaptation planning, integrating physical and transition risks into core financial reporting.

IFRS S2: Emerging global standard

IFRS S2 builds on TCFD with detailed governance and financial impact requirements, gaining traction in the UK, Canada, Australia, and beyond as the baseline for climate disclosures.

California SB 261 & regional regulations

California’s SB 261 demands TCFD-aligned climate risk reporting from 2026, with New York’s SB 3697 following suit, signaling US state-level momentum amid federal uncertainty.

Navigating overlapping requirements

With over 30 jurisdictions now requiring climate-risk related disclosures, navigating the increasingly complex regulatory landscape can be challenging. As a first step, utilise the TCFD as the common foundation and basis. From there, layer jurisdiction-specific adaptions for efficient regulatory compliance and to avoid doubling efforts when needing to comply for multiple jurisdictions.

Getting started: Practical recommendations

Forward-thinking businesses begin with pragmatic steps:

- Start small, build progressively: Focus initially on high-priority assets or regions, expanding scope as capabilities mature.

- Prioritise high-impact assets: Map critical operations, supply chain nodes, and revenue drivers against likely climate hazards.

- Resource allocation and governance: Embed climate risk within enterprise risk frameworks with clear board oversight and cross-functional accountability.

For detailed methodology on climate risk assessment and mitigation, watch our on-demand webinar!

From risk to readiness

Climate risk manifests as physical disruption and transition pressures but when managed proactively becomes a source of resilience and advantage. Businesses integrating climate risk into strategy protect value, satisfy regulators, and lead markets. The imperative is clear: treat climate risk as financial risk to thrive amid uncertainty.

Ready to future-proof your business?

Nexio Projects is a pure-play sustainability consultancy, providing support with repprting, climate risk and more. We deliver targeted climate risk solutions across 4+ major frameworks and 10+ sectors like chemicals, logistics, and food & beverage. Our climate experts provide comprehensive assessments aligned with TCFD, ESRS, and global regulations – identifying risks, enhancing resilience, and ensuring compliant disclosures.

Book a free consultation today to mitigate threats and unlock strategic advantage.

If you’d like to receive regular sustainability updates, subscribe to our newsletter.

References

- Potsdam Institute for Climate Impact Research, 2024. Economic Effects of Climate Change: A Global Assessment. Journal of Climate Economics, 12(3), pp.45-67.

- Task Force on Climate-Related Financial Disclosures (TCFD), 2023. Implementation Guidance for Climate Risk Assessment.

- World Economic Forum, 2024. The Cost of Inaction: A CEO Guide to Navigating Climate Risk. [online] Available at: https://www.weforum.org/publications/the-cost-of-inaction-a-ceo-guide-to-navigating-climate-risk/ [Accessed 18 September 2025].