An introduction to corporate sustainability training

An introduction to corporate sustainability training

With sustainability becoming a cornerstone of modern business practices, regulatory frameworks are evolving to promote transparency and accountability. A significant step in this direction happened on January 5, 2023. On that day, the European Union introduced the Corporate Sustainability Reporting Directive (CSRD).

This directive mandates companies that meet specific criteria to provide detailed sustainability reports. The goal of the CSRD is to bring sustainability reporting at the same level with financial reporting, ensuring that companies provide comparable, relevant, reliable, and data-driven information on their sustainability-related impacts, risks and opportunities.

But what does this mean for businesses, and how should they prepare to comply?

- The European Sustainability Reporting Standards (ESRS) are at the centre of the CSRD. EFRAG, a private group working together with multiple stakeholders and the EU Commission, created these standards.

- The first draft of the ESRS came out on December 22, 2022, while the final version was adopted by the EU Commission on July 31, 2023. The ESRS set the foundation for a standardised, robust and transparent reporting framework.

ESRS at a glance

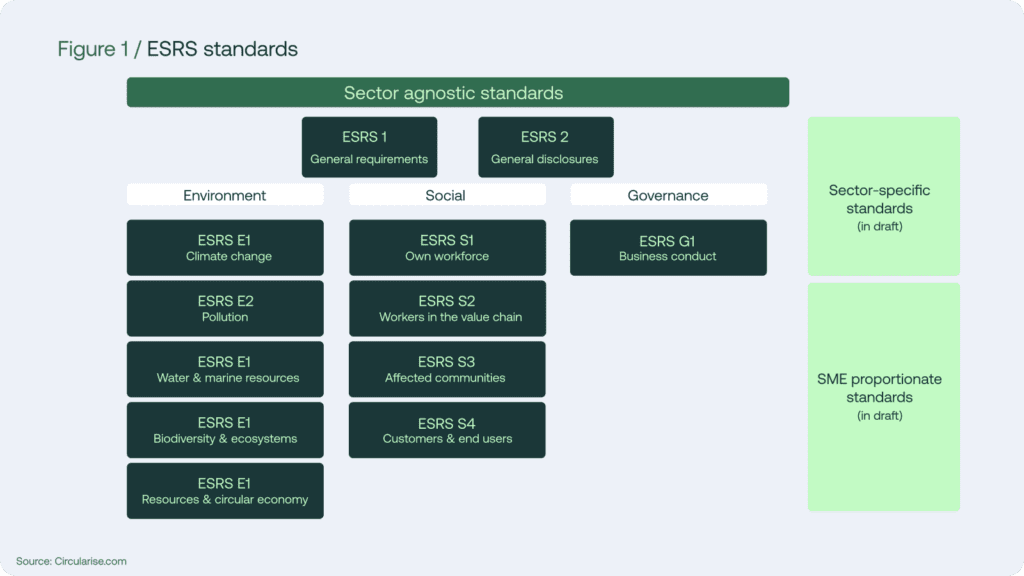

The draft European Sustainability Reporting Standards introduces 12 distinct standards, split into two categories:

Mandatory cross-cutting standards

This framework has two important standards for sustainability reporting: ESRS 1 (General Requirements) and ESRS 2 (General Disclosures).

ESRS 1 outlines the basic principles, concepts, and requirements for sustainability reporting. ESRS 2 describes the general information that companies need to share.

ESRS 1: General requirements

ESRS 1 lays the groundwork for clear and comparable sustainability reporting. It explains the key ideas and rules that companies need to follow. This standard provides the architectural blueprint for ESRS, explaining key concepts, drafting conventions, and general requirements for preparing and presenting sustainability-related information. It ensures that all companies, regardless of their sector, have a common starting point for their sustainability disclosures.

ESRS 2: General disclosures

Building on the foundation laid by ESRS 1, ESRS 2 delves into the specifics of what companies must disclose in their sustainability reports. This standard provides a clear way to report on sustainability. It highlights three key areas that companies must focus on. Disclosure requirements included in ESRS 2 are mandatory and apply to all companies within the scope of the CSRD.

Key focus areas in ESRS 2

ESRS 2 emphasises three crucial components:

- Governance

The governance pillar shines a spotlight on how sustainability is integrated into a company’s leadership and decision-making processes. It requires companies to disclose:

- The composition and responsibilities of administrative, management, and supervisory bodies

- How these bodies are informed about and address sustainability matters

- The integration of sustainability performance into incentive schemes

- Due diligence processes related to sustainability

This focus on governance ensures that sustainability is not just a peripheral concern but a core component of corporate strategy and operations.

- Strategy, metrics, and targets

Under the strategy pillar, companies must articulate how they approach sustainability in their business model and value chain. This includes:

- Describing the company’s market position and how it relates to sustainability

- Explaining how stakeholder interests are considered in strategy formulation

- Outlining the company’s approach to innovation and sustainable products or services

By requiring these disclosures, ESRS 2 encourages companies to think holistically about how sustainability fits into their long-term business strategy. Of course, strategy-setting does not go without setting metrics and targets. The European Sustainability Reporting Standards emphasises the importance of quantifiable goals and performance indicators.

Companies are required to:

- Set and disclose sustainability-related targets

- Report on key performance indicators (KPIs) related to their material topics

- Provide transparency on data sources, methodologies, and any uncertainties in their reporting

- Impact, Risk, and Opportunity (IRO) Management: Organisations must articulate their approach to managing their sustainability-related impacts, risks, and opportunities. Key aspects include:

- Describing processes for identifying material impacts, risks, and opportunities

- Outlining policies and actions taken to address these issues

- Explaining how the company engages with affected stakeholders

Ten topical standards

Besides cross-cutting standards, the ESRS include 10 topical standards encompassing various environmental, social, and governance (ESG) sustainability matters. In contrast to the cross-cutting standards ESRS 1 and 2, disclosure requirements included in the 10 topical standards are subject to the Double Materiality Analysis (DMA).

- ESRS E1 – Climate Change

- ESRS E2 – Pollution

- ESRS E3 – Water and Marine Resources

- ESRS E4 – Biodiversity and Ecosystems

- ESRS E5 – Resource Use and Circular Economy

- ESRS S1 – Own Workforce

- ESRS S2 – Workers in the Value Chain

- ESRS S3 – Affected Communities

- ESRS S4 – Consumers and End-Users

- ESRS G1 – Business Conduct

The role of double materiality

One of the ESRS framework’s defining features is its emphasis on double materiality (DMA), particularly for impact, risk, and opportunity (IRO) disclosures. Double materiality requires businesses to evaluate and report on sustainability topics from two perspectives:

- Impact Materiality – How the company’s operations affect people, stakeholders, and the environment (inside-out).

- Financial Materiality – How sustainability issues influence the company’s financial performance and resilience (outside-in).

If a business deems a topic impact material. financially material, or both, it must report on it..

Discover how your organization can navigate sustainability solutions and meet evolving CSRD (Corporate Sustainability Reporting Directive) requirements with our comprehensive resources. Check out our detailed guide on CSRD reporting requirements. It includes insights on CSRD scoping and tips for meeting CSRD double materiality standards.

Watch out for regulatory developments

In the world of ESG regulations, the only constant is change. There are frequent updates in relation to the CSRD and other EU regulations which it is important for your company to keep abreast of. Of particular importance is the Omnibus regulation, which is due to be announced on 26th February. The regulation will attempt to consolidate and simplify overlapping obligations from CSRD, Taxonomy and CSDDD. This initiative is part of the EU’s broader effort to streamline its legislative environment and enhance competitiveness while maintaining high ESG standards.

Frequently asked questions

What are the European Sustainability Reporting Standards (ESRS)?

The ESRS are a set of mandatory reporting standards under the EU’s CSRD regulation that guide how companies must disclose sustainability information, ensuring consistency and comparability across all sectors.

Who is required to comply with ESRS?

ESRS applies to large EU companies, listed SMEs, and certain non-EU companies with significant operations in the EU, typically those exceeding set thresholds for employees, turnover, or total assets.

What is the difference between CSRD and ESRS?

The CSRD is the overarching EU regulation that mandates sustainability reporting, while the ESRS provide the detailed technical standards and disclosure requirements companies must follow to comply.

How can companies prepare for ESRS compliance?

Businesses can prepare by conducting a double materiality assessment, identifying relevant data sources, aligning existing sustainability reports with ESRS topics, and implementing governance structures for data quality.

What are the benefits of aligning with ESRS early?

Early alignment helps companies streamline reporting, avoid compliance risks, enhance investor confidence, and position themselves as leaders in transparent sustainability communication.

How Nexio Projects can help

Named one of the world’s top 10 boutique ESG and sustainability strategy consultancies by Verdantix, Nexio Projects is your full-service sustainability partner. We help companies navigate complexity, seize opportunities, and build sustainability into the core of their operations.

Adapting to the CSRD’s stringent requirements may seem overwhelming, but expert support can make the process seamless. Nexio Projects, a leading consultancy, specialises in helping companies conduct double materiality assessments and prepare for CSRD compliance. Whether you need guidance on reporting strategies or a partner to navigate this transition, Nexio Projects is here to help. Get in touch today to take the first step toward transparent and impactful sustainability reporting!

Are new EU regulations and standards on your radar? Subscribe to our newsletter to stay informed on how these changes could affect your business.

Have more questions? Get in touch with our experts.