Everything you wish you knew before writing a sustainability report

Everything you wish you knew before writing a sustainability report

“Decarbonisation isn’t just about saving the planet—it’s about future-proofing your business. The companies leading this charge aren’t just reducing emissions; they’re reaping substantial financial rewards.”

The business imperative of decarbonisation

Across Europe, forward-thinking companies are discovering that decarbonisation delivers measurable returns that extend far beyond environmental benefits. While the initial investment might seem daunting, the financial upside is becoming impossible to ignore. Consider these compelling statistics:

Companies with strong decarbonisation strategies achieve 18% higher EBIT margins than their peers (1).

The EU’s Carbon Border Adjustment Mechanism will add €15-30 billion in costs to high-carbon imports by 2026 (2).

73% of European consumers now factor sustainability into purchasing decisions (3).

At Nexio Projects, we’ve observed a clear pattern: businesses that treat decarbonisation as a strategic priority rather than just a compliance exercise consistently outperform their competitors.

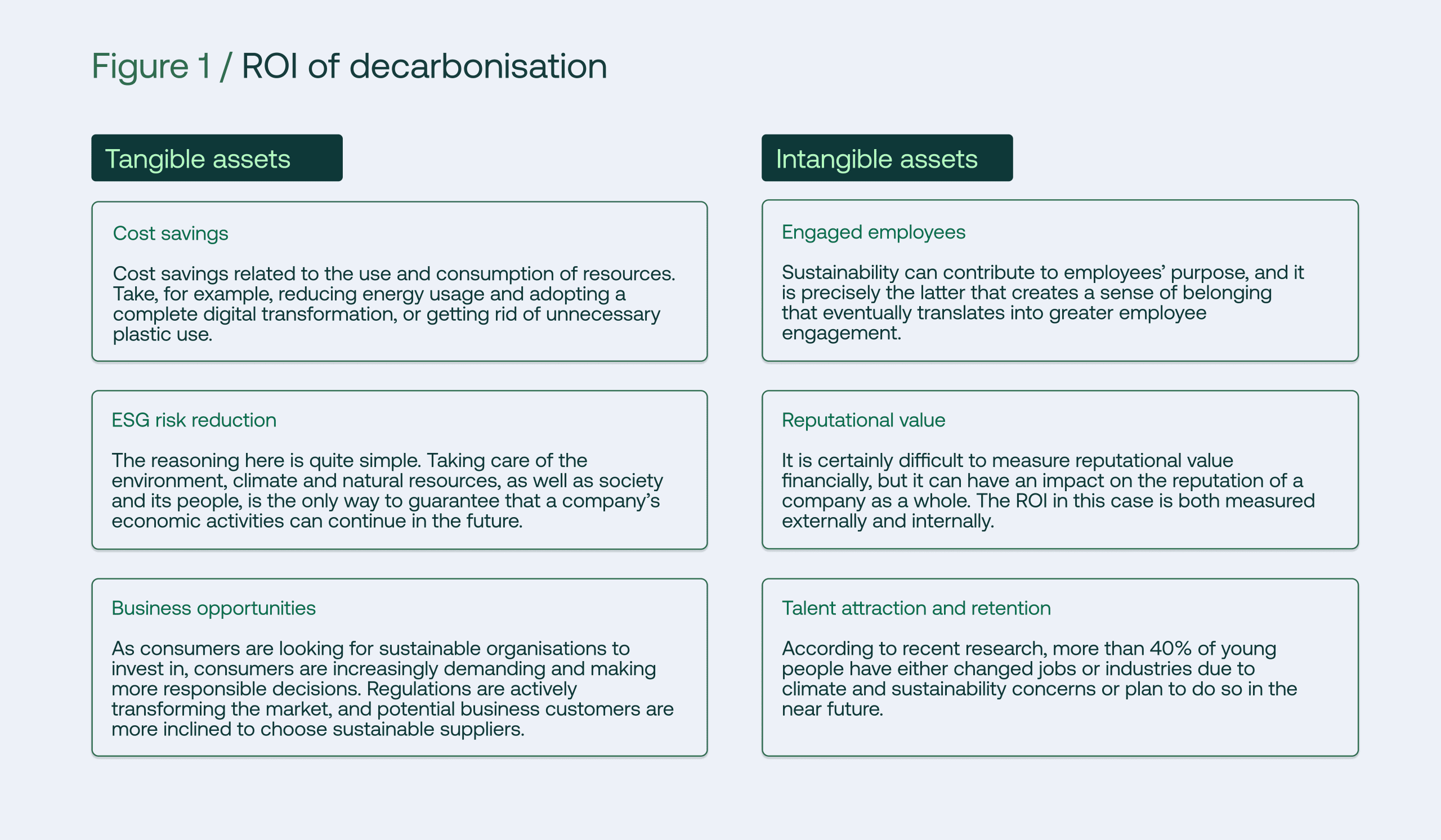

Yet many businesses remain hesitant, intimidated by upfront investments. This hesitation overlooks the four interconnected value streams that make decarbonisation a financial imperative:

- Operational efficiency

- Market differentiation

- Risk mitigation

- Talent & innovation

Operational efficiency: Where emissions reduction meets cost savings

Climate change is no longer a distant threat but a present operational reality. Companies delaying decarbonisation now face a perfect storm of regulatory penalties, supply chain vulnerabilities, and investor scrutiny. These converging pressures make operational decarbonisation both a defensive necessity and offensive opportunity.

Forward-thinking organisations treat emissions reduction as a triple-value lever: cutting costs, future-proofing operations, and unlocking competitive advantage. For example, climate risk assessments frequently reveal that energy efficiency upgrades in manufacturing facilities simultaneously reduce both carbon footprints and operational expenses, with most projects paying for themselves within 3 years.

Proactive companies are going further by geospatial mapping their facilities against climate models, identifying which sites need flood-resistant retrofits or onsite renewables to ensure continuous production. This strategic approach transforms compliance into profit, as seen with Continental AG’s 22% energy cost reduction through AI-driven optimisation—a system that also made their German plants resilient to energy price spikes during the 2022 crisis.

Case Study: Heidelberg Materials’ carbon-neutral cement plant

Challenge: As the cement industry leader, Heidelberg Materials recognised the need to reduce emissions at one of their sites in response to environmental challenges and emissions targets. The company was keen to adopt innovative technologies and methods to tackle these challenges.

Solution: Germany’s leading cement producer transformed its operations by:

- Installing carbon capture technology (CCUS) at its Brevik plant

- Switching to alternative fuels and raw materials

- Implementing advanced process optimisation

Results: A 50% reduction in CO₂ emissions was achieved while reaching €12 million in annual energy savings. The project paid for itself in under five years through operational efficiencies alone.

Key Insight: Energy efficiency measures typically deliver payback periods of 2-5 years, with ongoing savings that directly improve bottom-line performance.

Source: Heidelberg Materials – Sustainability

Gaining competitive advantage through decarbonisation

Decarbonisation is no longer just a compliance exercise — it is rapidly becoming a key market differentiator. As consumers, investors, and procurement teams increasingly prioritise sustainability, businesses that act early are positioning themselves as leaders in their industries. These companies are not only shaping industry standards but also securing long-term partnerships, capturing climate-conscious customers, and developing innovative low-carbon products and services that open up entirely new market segments.

The numbers speak for themselves:

- 89% of institutional investors demand clear climate action plans from the companies they invest in (4).

- The global market for low-carbon products is projected to exceed €250 billion by 2030, with sectors like renewable energy, green construction, and electric vehicles leading the charge (1).

This shift is particularly evident in procurement practices. Large corporations and public institutions are embedding sustainability criteria into their supply chain decisions. For example, the EU’s Green Public Procurement (GPP) framework prioritises suppliers with strong decarbonisation strategies, creating a competitive advantage for businesses that can demonstrate low-carbon credentials. Companies that fail to adapt are risking exclusion from lucrative contracts.

The regulatory landscape is also evolving rapidly. Policies like the EU’s Carbon Border Adjustment Mechanism (CBAM) are reshaping global trade by penalising high-carbon imports. Businesses that proactively reduce emissions will not only avoid these costs but also position themselves as preferred partners in industries transitioning to net zero sustainability. Early movers are already reaping the benefits:

- Siemens, by adopting science-based targets and committing to 100% renewable energy across its operations by 2030, has secured contracts for green infrastructure projects across Europe.

- H2 Green Steel, based in Sweden, raised €1.5 billion to build Europe’s first large-scale green steel plant powered by hydrogen, positioning itself as a leader in decarbonised manufacturing while securing long-term contracts with automotive giants like BMW.

Case Study: Schneider Electric’s decarbonisation leadership

Challenge: As a global player, Schneider Electric sought a compelling method to differentiate itself from its competitors in the global marketplace. The company recognised the shifting dynamics in consumer and investor expectations, emphasising the value of sustainability.

Solution: Schneider Electric, a global leader in energy management and automation headquartered in France, exemplifies how decarbonisation drives competitive advantage:

- By committing to net-zero operations by 2030 and launching its Green Premium™ program, Schneider has developed products that reduce emissions across their lifecycle while commanding higher price premiums.

- The company has partnered with major clients like Unilever and Walmart to help them decarbonise their supply chains through energy-efficient solutions.

Results: Schneider’s leadership has resulted in increased customer loyalty and a 30% growth in revenue from sustainable solutions over the past five years.

Industry Benchmark: Products with credible sustainability certifications achieve 5-30% higher margins across most sectors (5).

Source: Schneider Electric’s Role in Supply Chain Decarbonization

Risk mitigation: Future-proofing against regulatory changes

Climate change presents growing risks to business operations, supply chains, and regulatory compliance. Companies that fail to decarbonise face higher costs from carbon taxes, potential supply chain disruptions from extreme weather events, and reputational damage from failing to meet stakeholder expectations. Managing these risks proactively is essential to maintaining business continuity and protecting long-term profitability.

Regulatory pressure reaches a tipping point:

- The EU Emissions Trading System (ETS) carbon price surged to €85/ton in 2024, a 240% increase since 2020. This trajectory is set to continue:

- The Carbon Border Adjustment Mechanism (CBAM) will impose costs on high-carbon imports starting in 2026, with steel, cement, and chemicals facing up to 10% turnover erosion by 2030 (2).

- Non-compliance with the Corporate Sustainability Reporting Directive (CSRD) risks fines up to €500K—and reputational damage that can depress market valuations (6).

Supply chain disruptions become the norm:

- 2024 set records for climate-driven business interruptions:

- 65% of European firms suffered weather-related supply chain disruptions last year (2).

- The Rhine River drought alone cost German industry €5B in lost output, exposing dependence on climate-vulnerable logistics routes (7).

Globally, such disruptions now drain $24.7 trillion annually from cascading delays and shortages (8).

Case Study: Ørsted’s energy transition – Turning risk into reward

Challenge: In the early 2000s, Ørsted (then DONG Energy) faced a looming financial threat. As Europe’s carbon pricing mechanisms strengthened, the company’s fossil fuel-dependent energy portfolio was becoming increasingly vulnerable. With 85% of its energy generation coming from coal and oil, rising carbon costs under the EU ETS were projected to erase profits within a decade. The writing was on the wall: adapt or face financial decline.

Solution: Ørsted made a radical strategic pivot:

- Completely exited coal by 2023, a decade ahead of most competitors

- Invested €30 billion to become the world’s largest offshore wind operator

- Developed new business models like Power-to-X for green hydrogen

- Aligned all investments with science-based targets

Results: This transformation delivered triple-layer protection against climate risks:

- Regulatory resilience: Avoided €2.3 billion in potential carbon costs

- Market leadership: 400% increase in market capitalisation (2016-2024)

- Future-proofing: Built a €15 billion offshore wind pipeline immune to carbon pricing

Source: Ørsted Annual Report 2023

The talent & capital magnet: How decarbonisation fuels growth

Decarbonisation is no longer just a corporate responsibility – it is becoming a key driver of investment and talent attraction. Investors and financial institutions are integrating environmental performance into their decision-making, favouring companies with clear carbon footprint measurement strategies. Businesses with strong decarbonisation commitments can access capital on better terms and attract investment from ESG-focused funds.

At the same time, top talent increasingly seeks employers with strong decarbonisation approaches. A clear decarbonisation pathway strengthens employer branding. Investing in transparent emissions reporting, setting ambitious carbon reduction targets, and integrating sustainability into corporate culture pays off by ensuring financial gains and top-tier talent attraction.

- 68% of European professionals prioritise employers with strong decarbonisation plans (4).

- Companies with science-based targets secure lower-cost capital (50-100 bps cheaper loans) (1).

- ESG funds now manage $40+ trillion, reshaping corporate valuations (8).

Case Study: Siemens’ green talent strategy

Challenge: As competition for skilled engineers intensified, Siemens needed a way to stand out. Traditional perks weren’t enough—younger talent wanted meaningful climate action.

Solution: Siemens embedded sustainability into its core operations:

- Made decarbonisation a key metric in hiring and promotions

- Launched employee “green innovation” challenges with €500K funding pools

- Set public, science-based targets to hold leadership accountable

Results: Siemens has achieved the following results:

- 22% lower turnover in sustainability-focused teams

- 45% more green patents filed within two years

- Top-ranked employer for engineering graduates

Source: Siemens Sustainability Report 2023

Frequently asked questions

What hidden value can decarbonisation bring to a business?

Beyond emission cuts, decarbonisation unlocks cost savings, improves operational efficiency, enhances brand value, and may open access to green finance and sustainability-linked incentives.

How can companies measure the return on investment (ROI) of decarbonisation initiatives?

They can calculate ROI by comparing upfront costs against avoided energy costs, lower carbon taxes, risk mitigation benefits, improved stakeholder perception, and increased revenue from sustainable products.

Which strategic actions drive the highest decarbonisation impact?

Strategic actions include targeting high-emitting value-chain processes, electrifying operations, shifting to renewable energy, engaging suppliers on Scope 3 emissions, and using analytics to optimise carbon reduction pathways.

What are the common barriers to delivering ROI from decarbonisation?

Barriers include lack of executive sponsorship, fragmented data systems, under-investment in change management, misalignment between carbon and business strategies, and failure to engage key partners.

When should a company start planning decarbonisation to maximise ROI?

To maximise ROI, companies should start now — ideally with a baseline footprint, clear targets, and roadmap — because longer-term actions allow more time to realise savings and align with regulatory or market shifts.

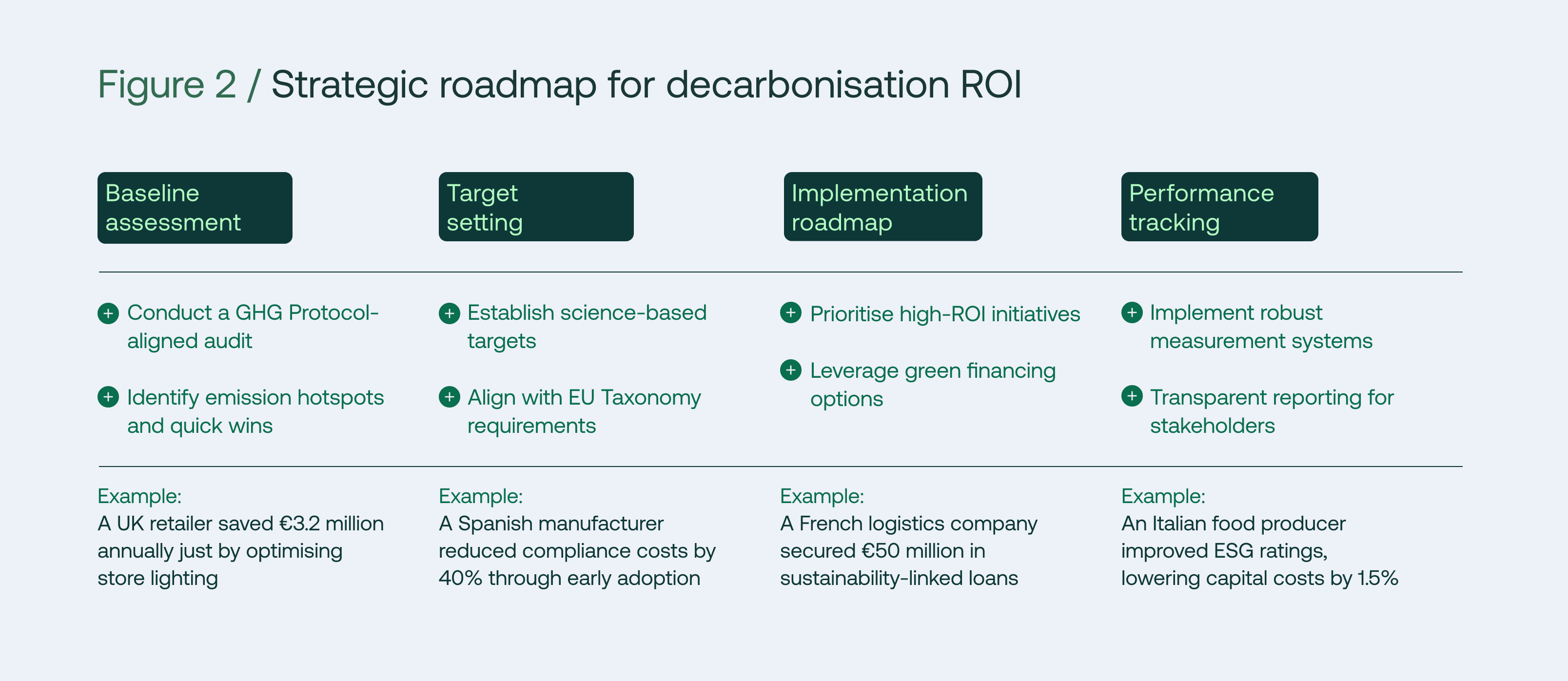

A strategic roadmap to decarbonisation ROI

The Nexio Projects way

Investing in decarbonisation is not just a climate imperative, it is a smart business move. At Nexio Projects, a leading sustainability consultancy based in Rotterdam, we help organisations unlock the return on investment (ROI) of carbon reduction strategies. Whether you are aiming to meet regulatory demands or improve your ESG ratings, our decarbonisation consultants bring the tools and expertise needed to align sustainability and business performance.

Why should you invest in a decarbonisation strategy?

• How can reducing emissions improve operational efficiency and reduce costs?

• What reputational benefits come with a clear net zero roadmap?

• How do carbon reduction plans attract investors and future-proof your business?

• Can decarbonisation drive product innovation and market differentiation?

• What are the financial and compliance risks of delaying action?

Based on our work with 100+ European companies, we recommend this proven approach:

Conclusion: Turning decarbonisation into action

To maximise the return on investment of decarbonisation, companies have to develop targeted and clear strategies. Any decarbonisation pathway starts with a GHG Protocol-aligned corporate carbon footprint assessment to identify emission hotspots. From there, setting science-based targets and integrating decarbonisation into the overall company strategy ensures long-term success. Collaborating with suppliers, investors, and industry-peers can accelerate this transition.

Decarbonisation is not just about meeting compliance requirements – it is an opportunity for companies to strengthen competitive positioning, attracting key stakeholders, and building future-proof operations. Companies that act now will not only mitigate risks but also unlock new pathways for growth and success in a low-carbon future. With tightening regulations, evolving consumer preferences, and growing investor expectations, the question isn’t whether to decarbonise – but how quickly and strategically you can act.

Start your decarbonisation journey today. Every month of delay means:

- Missed efficiency savings

- Lost competitive advantage

- Growing compliance costs

“In the race to net zero, the early movers aren’t just saving the planet – they’re dominating their markets.”

If you are looking to learn how to decarbonise your business, download our guide which explains mapping your GHG emissions, with a specific focus on tackling Scope 3 emissions.

Even more curious about the ROI of sustainability? Join our newsletter to explore how sustainability initiatives can drive business value.

Would you like to discuss how these strategies could apply to your specific business context? Our team of European sustainability experts can help you identify your highest-ROI decarbonisation opportunities.

References:

- McKinsey & Company. (2024). The Economic Case for Decarbonization in European Industry. https://www.mckinsey.com/industries/electric-power-and-natural-gas/our-insights/the-economic-case-for-decarbonization-in-european-industry

- European Commission. (2024). Carbon Border Adjustment Mechanism: Implementation Guidelines. https://ec.europa.eu/taxation_customs/green-taxation-0/carbon-border-adjustment-mechanism_en

- Eurobarometer. (2024). European Attitudes on Climate Change and Sustainable Consumption. Special Eurobarometer 524.

- LinkedIn. (2024). Global Green Skills Report 2024. https://economicgraph.linkedin.com/en-us/research/labor-market-research/green-skills-report

- Bain & Company. (2024). The Sustainability Premium: How Green Products Command Higher Prices. https://www.bain.com/insights/the-sustainability-premium/

- Heidelberg Materials. (2023). Annual Sustainability Report: Brevik CCS Project Case Study. https://www.heidelbergmaterials.com/en/sustainability

- Ørsted. (2023). Annual Report: Our Green Transformation Journey. https://orsted.com/en/investors/financial-reports

- Siemens AG. (2023). Sustainability Report: Green Talent and Innovation. https://new.siemens.com/global/en/company/sustainability.html

- Schneider Electric. (2021, February 24). Schneider Electric advances corporate climate action with global supply chain decarbonization service. Schneider Electric. https://www.se.com/ww/en/about-us/newsroom/news/press-releases/schneider-electric-advances-corporate-climate-action-with-global-supply-chain-decarbonization-service-60352b6dd55edc092248d9c6