Why you should pay attention to the biodiversity crisis

Why you should pay attention to the biodiversity crisis

“2025 marks a new era for sustainability reporting – one defined by shifting regulations, digital transparency, and the expectation that companies lead with both ambition and accountability.”

The new rules of the game

Sustainability reporting has undergone a seismic shift. In 2025, it’s no longer a voluntary exercise or a marketing add-on. It’s a strategic, regulated process that shapes how companies are perceived by investors, customers, employees, and regulators. With the EU Corporate Sustainability Reporting Directive (CSRD), new climate disclosure rules in the US and Asia, and the rise of global standards like the ISSB’s IFRS S1 and S2, the bar for transparency and accountability has never been higher.

Organisations are now expected to publish assured, digital, and comparable data on their environmental, social, and governance (ESG) performance. The focus has shifted from simply telling a sustainability story to proving real-world impact with evidence, clarity, and honesty.

Why 2025 is different: Regulation, digitalisation, and stakeholder trust

In previous years, companies could choose their reporting frameworks and focus areas. Today, regulatory requirements dictate not only what must be reported, but also how and when. Under the CSRD, for example, companies must conduct double materiality assessments, apply digital tagging to sustainability data, and obtain third-party assurance.

Additionally, because the CSRD integrates sustainability disclosures into the annual management report, this non-financial data is now published alongside financial results—ensuring accessibility and verification by all stakeholders. It’s worth noting that under the European Commission’s 2025 Omnibus proposal, some of these requirements—such as the effective dates for certain companies and the volume of mandatory data points—are being postponed and simplified to reduce administrative burdens and allow more time for preparation.

As a result, while the core principles of transparency and comparability remain, many entities will see delayed timelines and a streamlined set of reporting obligations. Digitalisation is also transforming reporting. Companies are expected to provide machine-readable data, use advanced ESG platforms for data management, and ensure their disclosures are audit-ready. This shift is helping to combat greenwashing, as regulators and stakeholders can now scrutinise claims more easily than ever before.

Building a 2025-ready sustainability report

1. Start with Double Materiality

The foundation of a credible sustainability report is a robust materiality assessment. Until now, companies typically relied on either financial materiality—focusing on how sustainability issues affect the business—or impact materiality, which considers the organisation’s effects on people and the planet. Under the CSRD, however, the norm is shifting toward a double materiality approach, which combines both perspectives. This dual lens ensures your report addresses what matters most to both your company and wider society.

A well-executed materiality assessment starts with understanding the broader ecosystem your organisation operates in. Engage a broad range of stakeholders—employees, suppliers, customers, investors, and communities—to identify and prioritise the most significant ESG issues. Materiality is not static; it should be revisited regularly as risks, regulations, and stakeholder expectations evolve.

Ørsted’s 2024 Annual Report presents a clear and effective Double Materiality Assessment (DMA), visualising material topics along the company’s entire value chain and consistently linking these outcomes to relevant disclosures. Their approach includes a detailed mapping of impacts, risks, and opportunities (IROs) across upstream, own operations, and downstream activities, using visual tools that make the distribution of each material topic easily understandable.

Notably, Ørsted reiterates in each topical standard section which IROs are most relevant within each part of the value chain, ensuring that the connection between the DMA findings and the required disclosures is always explicit. This method not only enhances transparency but also demonstrates how materiality outcomes directly inform sustainability reporting, making Ørsted’s approach a strong example of best practice in reporting aligned with CSRD reporting requirements.

2. Integrate sustainability and financial reporting

Gone are the days of the standalone sustainability report. Today’s leading companies weave ESG disclosures into their annual reports, demonstrating how sustainability strategy is central to business strategy and long-term value creation. This integration is not just about compliance-it’s about showing how your sustainability efforts drive business resilience and opportunity.

For instance, Danish logistics leader Maersk’s latest integrated annual report exemplifies this approach. By aligning climate targets, supply chain decarbonisation, and workforce initiatives directly with financial performance, Maersk provides stakeholders with a holistic view of risk, opportunity, and progress. Their report is digitally tagged, assured by a third party, and includes both achievements and ongoing challenges, setting a high bar for transparency.

3. Prioritise data quality and assurance

With regulatory scrutiny shifting, the accuracy and reliability of your data are paramount. Invest in robust ESG data management systems that enable automated data collection, validation, and reporting. Ensure your disclosures are audit-ready and seek independent assurance to build credibility and trust.

Be transparent about your methodologies, data sources, and any limitations. Stakeholders are increasingly wary of greenwashing, making it essential to acknowledge both successes and areas where improvement is needed.

4. Tell a clear, honest story

While data is crucial, narrative matters too. Use your report to explain your sustainability journey-why you’ve set certain goals, the challenges you face, and how you’re adapting to new risks and opportunities. Avoid jargon and overly technical language; instead, focus on clarity and accessibility.

Balance ambition with realism. Stakeholders appreciate honesty about setbacks and the steps you’re taking to address them. For example, if supply chain disruptions have temporarily increased your emissions, explain the context and outline your plan for getting back on track.

5. Leverage technology and innovation

Digital tools are now essential for effective sustainability reporting. From carbon accounting platforms to AI-powered data analytics, technology can streamline data collection, enhance accuracy, and facilitate real-time reporting. Embrace digital reporting formats, such as XBRL, to meet regulatory requirements and make your data more accessible to analysts and investors.

6. Engage and educate stakeholders

A great sustainability report is more than a compliance document-it’s a tool for engagement. Use it to start conversations with employees, customers, investors, and communities. Provide clear calls to action, invite feedback, and show how stakeholder input shapes your strategy.

Internal engagement is equally important. Involve cross-functional teams in the reporting process and use the report as a catalyst for building a sustainability culture across the organisation.

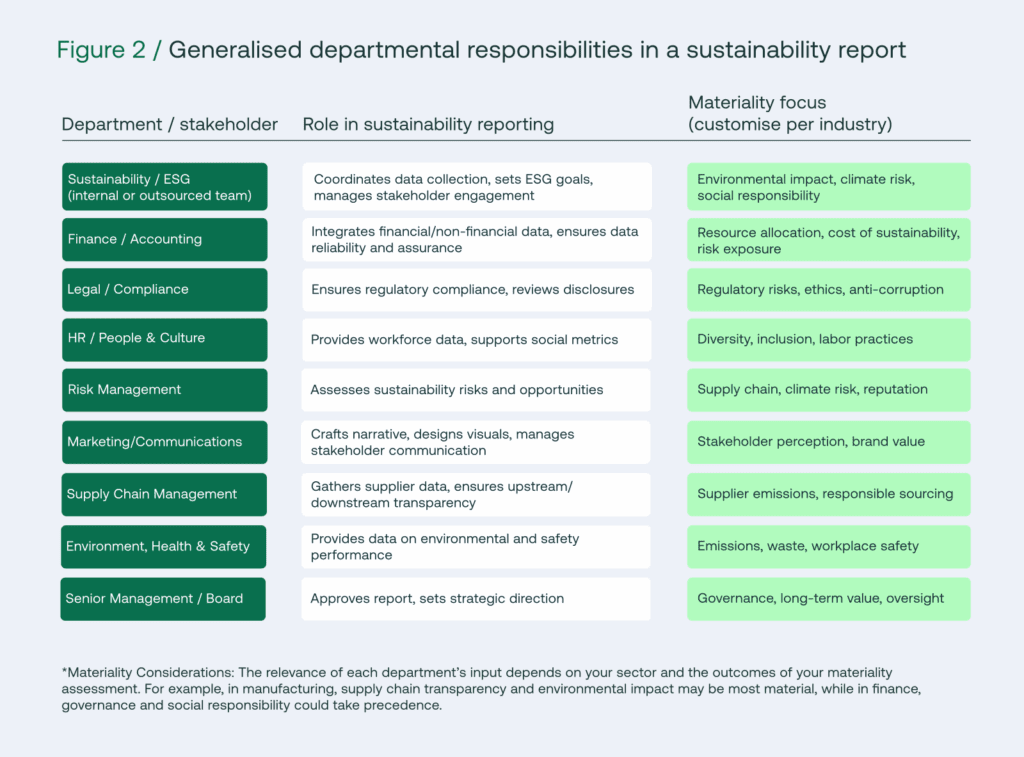

Effective sustainability reporting relies on cross-functional collaboration, with each department playing a distinct role in contributing data, insights, and oversight across key ESG dimensions. Here is what that looks like:

Leveraging your Marketing team for a visually impactful sustainability report

Don’t underestimate the power of your marketing team in elevating your annual sustainability report. Beyond compliance, a compelling report is a communication tool that can drive engagement, shape perceptions, and spark action among stakeholders. Marketing professionals bring expertise in storytelling, branding, and-crucially-visual design. By collaborating with them, you can transform complex ESG data into clear, visually engaging narratives that resonate with diverse audiences.

Effective use of visuals-such as infographics, clean charts, real-life photos, and interactive dashboards-makes your report not only more attractive but also easier to understand. Data visualisation is particularly powerful in sustainability reporting, as it translates intricate information on emissions, resource use, or social impact into accessible formats that reveal trends and progress at a glance. For example, geographical maps can highlight supply chain risks, line graphs can show emissions reductions over time, and dashboards can provide a real-time overview of key sustainability metrics. These visual elements not only capture attention but also empower stakeholders to grasp material issues and make informed decisions.

Nike’s and Apple’s sustainability reports are prime examples, using authentic imagery and minimalistic charts to create emotional connection and clarity, while Dümmen Orange’s report enlivens governance sections with team photos, reinforcing transparency and trust. By integrating your marketing team early in the process, you ensure your report is not just compliant, but also compelling and memorable.

Common pitfalls and how to avoid them

Learn from leading examples

A.P. Moller-Maersk offers a strong example of best practice in 2025. Their integrated annual report aligns with ESRS, embedding sustainability performance within financial disclosures. Maersk’s transparent discussion of both progress (such as expanding their dual-fuel vessel fleet for decarbonisation) and challenges (like increased emissions due to global disruptions) demonstrates the value of honest, data-driven reporting. The company’s approach to double materiality, digital data tagging, and third-party assurance sets a benchmark for others aiming to comply and lead.

Looking ahead: Turning compliance into competitive advantage

In 2025, ESG reporting is a gateway to stronger stakeholder trust, better risk management, and long-term business value. Companies that treat reporting as a strategic opportunity-not just a compliance exercise-will stand out in an increasingly crowded field.

By grounding your report in double materiality, integrating it with financial disclosures, prioritising data quality, and engaging stakeholders, you can not only meet regulatory requirements, but also build a foundation for sustainable growth.

Frequently asked questions

What major changes in sustainability reporting are coming in 2025?

In 2025, companies will face stricter requirements such as the Corporate Sustainability Reporting Directive (CSRD) rollout in the EU, mandatory assurance of sustainability data, and increased scope 3 disclosures, all demanding higher transparency and standardisation.

Which companies will be required to follow new reporting standards in 2025?

Large EU-based companies, listed SMEs, and non-EU entities with significant EU operations will be subject to the CSRD and related standards such as the European Sustainability Reporting Standards (ESRS), depending on size and turnover thresholds.

How should organisations update their reporting process to stay ahead in 2025?

Organisations should revise their governance and data-collection systems, embed a double-materiality assessment, align with ESRS topics, adopt digital tagging, and prepare for external assurance to meet evolving stakeholder and regulatory demands.

What are common pitfalls companies should avoid in their 2025 sustainability reports?

Common mistakes include treating sustainability reporting as an annual checklist rather than an ongoing process, ignoring value-chain impacts (Scope 3), relying on outdated data, and lacking clear governance and assurance mechanisms.

How can sustainability reporting drive leadership, not just compliance?

By integrating reporting insights into business strategy, setting bold sustainability goals, engaging stakeholders proactively, and using disclosures as a communication tool, companies can shift from compliance to leadership and create competitive advantage.

Ready to lead the way in sustainability reporting?

Whether you need a gap analysis, bespoke workshops, outsourced sustainability management, or hands-on support with your next sustainability & impact report, we combine global perspective with local insight to help you unlock the full value of sustainability reporting.

Who are we?

Nexio Projects is your full-service sustainability partner, helping you break down complex challenges and take bold steps toward ambitious climate action. Named one of the top 10 ESG and sustainability strategy consultancies worldwide by Verdantix, we bring clarity to every stage of your sustainability journey. From initial reporting frameworks to long-term strategic implementation, our team of 30+ experts is dedicated to helping you advance your purpose and meet evolving regulatory demands

We offer specialised support in key areas of ESG reporting, including:

- Sustainability report creation

- CSRD implementation, simplifying compliance with ESRS standards

- Double materiality assessments to align with EU expectations and stakeholder priorities

- End-to-end ESG reporting for greater transparency, credibility, and impact

Download our 2025 sustainability reporting guide below or contact Nexio Projects for tailored support on your next report.

By embracing these best practices, your organisation can transform sustainability reporting from a regulatory hurdle into a powerful tool for transparency, accountability, and positive impact.

Recommended sustainability and impact reports for further inspiration

- Nike (FY23 Impact Report)

- Features a visually engaging timeline and performance summary, aligning sustainability with brand narrative.

- Prioritises issues using SDGs and presents quantifiable data through clear visualisations.

- Includes a hyperlinked table of contents, CEO letter, and a detailed appendix with a GRI (Global Reporting Initiative) index for easy navigation and transparency.

- Apple (2024 Environmental Progress Report)

- Highly structured, with clear sections on methodology, data, and lifecycle assessment.

- Blends storytelling (e.g., the “Mother Nature” campaign) with transparent disclosure of both achievements and challenges.

- Uses infographics, timelines, and product-level carbon data to make complex information accessible.

- Zeeman (Sustainability Initiatives)

- Anchors reporting in the company’s “Zuinig” philosophy, with a strong narrative on value creation and impact along the supply chain.

- Employs materiality matrices, connectivity diagrams, and concise explanations of key themes, supported by stakeholder dialogue and risk analysis.

- Visuals and matrices help communicate priorities and progress effectively.

- Maersk (2024 Integrated Annual Report)

- Fully CSRD-aligned, integrating sustainability and financial disclosures in a single report using the “incorporation by reference” method.

- Clearly outlines double materiality methodology, stakeholder engagement strategy, and validation steps, with visuals mapping material topics and ESG strategy.

- Includes detailed roadmaps, KPIs, and transparent discussion of challenges and progress.

- Ørsted (2024 Annual Report)

- Exemplifies CSRD compliance with a dedicated “Sustainability Statements” section, extensive narrative disclosures, and a transparent double materiality assessment.

- Uses value chain mapping, clear infographics, and margin notes to document methodologies and assumptions.

- Iterative approach to methodology and stakeholder engagement, with strong integration of narrative and data.

See more best practices for impact reports in our on-demand video about the importance of Double Materiality Assessments.

As the sustainability reporting landscape continues to evolve, staying ahead requires clarity, coordination, and a strategic approach. Download our latest sustainability reporting guide to help your organisation navigate complexity, meet regulatory expectations, and turn ESG reporting services into a driver of long-term value.

Additionally, our monthly newsletter gives timely updates around shifting regulations, best practices and trends in the reporting and ESG scene. Subscribe now and stay ahead of the curve!

Have more questions? Get in touch with our experts for a free consultation.

References:

A.P. Moller – Maersk, 2024. Annual Report 2024. [pdf] Available at: https://www.maersk.com/~/media_sc9/maersk/corporate/sustainability/files/resources/2024/maersk-annual-report-2024.pdf [Accessed 24 Jun 2025].

Nike, n.d. Impact Report. [online] Available at: https://about.nike.com/en/impact [Accessed 24 Jun 2025].

Apple, 2024. Environmental Progress Report 2024. [pdf] Available at: <insert correct full link when available> [Accessed 24 Jun 2025].

Zeeman, n.d. Nederlandse consumenten zien Zeeman als meest duurzame merk in kledingindustrie – o retalhista de moda mais transparente de Zeeman. [online] Available at: https://www.zeeman.com/pt-pt/comunicados-de-imprensa/nederlandse-consumenten-zien-zeeman-als-meest-duurzame-merk-in-kledingindustrie–o-retalhista-de-moda-mais-transparente-de-zeeman [Accessed 24 Jun 2025].

Ørsted, 2024. Annual Report 2024. [pdf] Available at: <insert correct full link when available> [Accessed 24 Jun 2025].

“Growing Together 2024” (ESG magazine) – PDF available at: https://emea.dummenorange.com/site/en/news-archive/detail/growing-together-2024-underlines-sustainability-efforts-dummen-orange/en-111-2201