Earth Day: An update on the planetary boundaries

Earth Day: An update on the planetary boundaries

Double Materiality Assessment: Definitions and key concepts

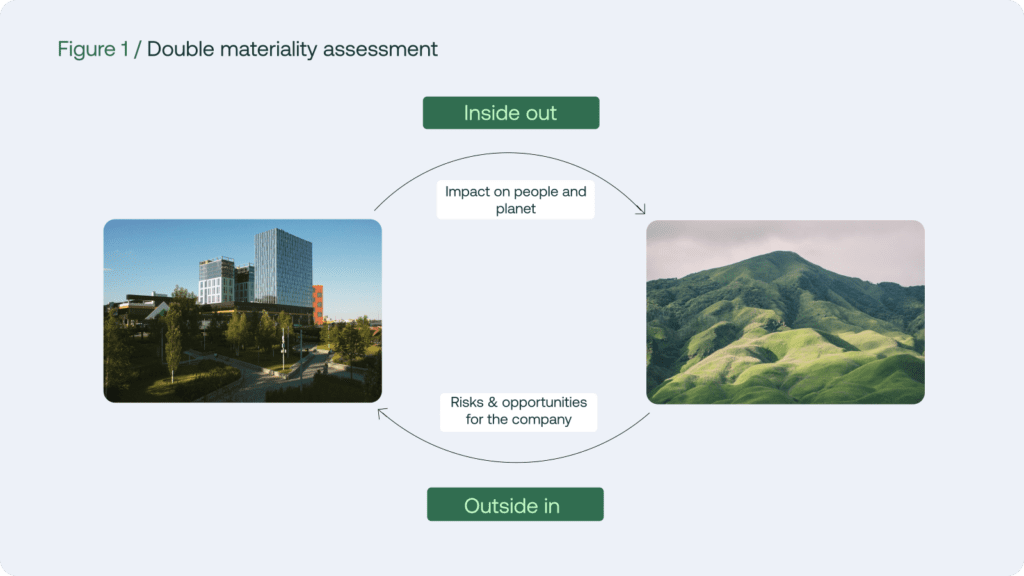

As the Corporate Sustainability Reporting Directive (CSRD) takes effect, companies are grappling with a framework for sustainability reporting: the Double Materiality Assessment (DMA). This crucial tool is becoming increasingly important, but many organisations find themselves asking, “What exactly is a DMA, and where do we begin?”

This article breaks down the complexities of the Double Materiality Assessment (DMA), offering a comprehensive roadmap for organisations navigating this strategic sustainability evaluation. This process encompasses a strategic evaluation of sustainability matters from two key angles: the financial and impact perspectives.

Outside In

“A sustainability matter is material from a financial perspective if it generates or may generate significant risks or opportunities that influence or are likely to influence the future cash flows and therefore the enterprise value of the undertaking in the short -, medium – or long -term, but it is not captured or not yet fully captured by financial reporting at the reporting date.” EFRAG / ESRS / CSRD

Inside Out

“A sustainability matter is material from an impact perspective if the undertaking is connected to actual or potential significant impacts on people or the environment over the short -, medium – or long -term. This includes impacts directly caused or contributed to by the undertaking in its own operations, products or services and impacts which are otherwise directly linked to the undertaking’s upstream and downstream value chain, not limited to contractual relationships.” EFRAG / ESRS / CSRD

A sustainability matter is considered material when it meets the criteria for impact materiality, financial materiality, or both, as defined by the European Financial Reporting Advisory Group (EFRAG) under the European Sustainability Reporting Standards (ESRS), which guide sustainability disclosures in alignment with the Corporate Sustainability Reporting Directive (CSRD).

To summarise, outside-in and inside-out perspectives focus on two key aspects of materiality:

- Outside-in (Financial Materiality): How sustainability factors affect a company’s financial performance and long-term viability.

- Inside-out (Impact Materiality): How a company’s operations impact the wider environmental and social context.

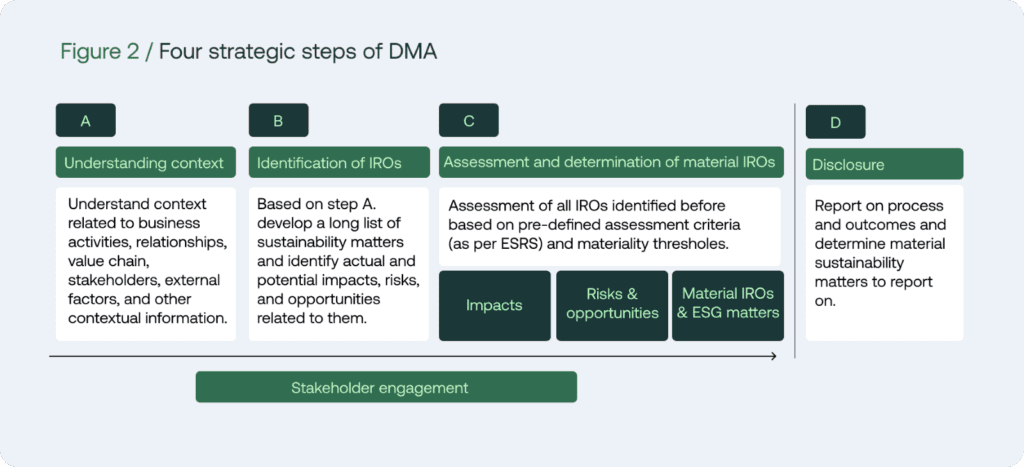

Four Strategic Steps of DMA

At Nexio Projects, we have developed a comprehensive four-step process for conducting a Double Materiality Assessment (DMA), aligning with EFRAG’s materiality implementation guidance. This approach considers all sustainability matters outlined in ESRS 1 paragraph AR16, as well as entity-specific topics. Let’s break down this process to help you navigate the complexities of DMA preparation.

A: Understanding context

The foundation of a robust DMA lies in gathering and analysing relevant documents. This includes information on business activities, relationships, value chain, external factors, and other contextual data. By having these documents ready from the start, you will streamline the subsequent IRO (Impacts, Risks, and Opportunities) identification process. We advise to stay updated on applicable regulations and compliance requirements for your business locations. This contextual understanding is crucial for a comprehensive assessment.

B: IROs Identification

Before a company can assess its sustainability risks and opportunities, it must first identify its IROs (Impacts, Risks, and Opportunities). This step is crucial in understanding how the company’s activities affect the environment and society, as well as how external sustainability factors may influence its business performance. The identification process follows the European Sustainability Reporting Standards (ESRS), which set guidelines for assessing sustainability issues across a company’s value chain. A key principle in this process is double materiality, meaning companies must evaluate both their impact on the world (impact materiality) and the risks and opportunities sustainability factors pose to their business (financial materiality).

To ensure a structured approach, companies should consider:

- Time Horizons: Clearly defining short-term (within one year), medium-term, and long-term impacts

- Type: Distinguishing between actual vs. potential IROs

- Impact Effects: Identifying whether the impact is positive or negative

This assessment ensures that the company identifies and evaluates all material IROs across its entire value chain, from upstream suppliers to downstream customers. The process leverages multiple sources, including the ESRS list of sustainability matters, industry-specific issues, and established ESG frameworks such as IFRS and GRI. By following this methodology, companies can effectively determine which sustainability matters are most significant to their operations and reporting obligations under the Corporate Sustainability Reporting Directive (CSRD).

C: Assessment and determination of material IROs

Once the company has identified the IROs, collaboration across departments is necessary to assess these risks and opportunities according to the criteria defined by the ESRS. These IROs encompass environmental, social, and governance aspects, and their assessment requires input from various stakeholders. Engaging stakeholders is essential in this process to confirm the significance of material IROs in relation to the materiality threshold. Involving stakeholders strategically enhances the DMA results by incorporating diverse perspectives and insights, which can be achieved through interviews with internal and/or external parties, such as Global EHS, suppliers, or customers.

To determine the score for material IROs, several criteria are considered;

Impact assessed based on:

- Scale: How grave the impact is to people and the environment?

- Scope: How widespread the impact is?

- Irremediability (for negative impacts): The extent to which the impact can be remediated

- Likelihood (for potential impacts): How likely underlying characteristics or overall impact is to materialise arise and affect people and the environment.

Financial assessed based on:

- Magnitude: How large are the financial effects over the short, medium, long term?

- Likelihood: What is the likelihood of this financial effect occurring?

D: Disclosure preparation step

The final step of the DMA process is disclosure, which involves preparing a report based on the results of the DMA and identifying the key sustainability issues to be reported. Throughout the DMA process, it is considered best practice to maintain thorough documentation, as this can be a complex and demanding undertaking. Having clear records enables the company to revisit and assess the documents, serving as a valuable resource for refining strategies in the years ahead. As this can be a challenging and intricate task, our team can support clients in compiling a complete and well-structured audit package, ensuring a smooth and effective disclosure process.

Frequently asked questions

What is double materiality and why is it important under CSRD?

Double materiality means companies must report both how sustainability issues impact their business (financial materiality) and how their business impacts society and the environment. Under the Corporate Sustainability Reporting Directive (CSRD), it becomes a core requirement.

What are the main steps in preparing for a CSRD-compliant materiality assessment?

The preparation process involves scoping your business context, engaging stakeholders, identifying relevant sustainability topics, assessing impact and enterprise risk, and documenting decisions in your reporting system.

Who must conduct a materiality assessment under CSRD?

CSRD applies to large EU-based companies and non-EU companies with significant presence in the EU; these entities must conduct double materiality assessments as part of their sustainability disclosures.

How can companies ensure their materiality assessment meets reporting standards?

To meet standards, companies should align with the Global Reporting Initiative (GRI) and ESRS frameworks, keep transparent documentation of stakeholder engagement and processes, and embed results into their governance and data-systems.

What common mistakes should companies avoid when preparing for CSRD materiality?

Common errors include treating materiality as a one-off task instead of an ongoing process, failing to involve senior leadership and stakeholders, and lacking clear data governance and audit trails.

Get in Touch with CSRD Experts at Nexio Projects

Who are we?

Nexio Projects is your full-service sustainability partner, helping you to break down complex challenges and target ambitious climate action. With deep expertise in regulatory frameworks and impact assessment methodologies, we help organisations navigate the dual lens of financial and impact materiality.

With our help, your materiality assessment becomes more than a box-ticking exercise — it becomes the foundation for a credible sustainability strategy.

Our four-step process for the Double Materiality Assessment (DMA) is a strategic initiative designed to assist companies in preparing for reporting under the Corporate Sustainability Reporting Directive (CSRD). Nexio Projects is an international consultancy focused on guiding organizations through their sustainability journeys, including compliance reporting.

With extensive experience in conducting DMAs across a diverse range of business portfolios, we are well-equipped to support your organization in navigating the complexities of CSRD compliance. Book a consultation with us to learn more about how we can help you on your sustainability journey!

Download our CSRD guide where we explain our approach and answer most asked questions:

Relevant source: EFRAG Implementation Guidance: Double Materiality