EcoVadis Platinum: From ambition to reality

EcoVadis Platinum: From ambition to reality

The Corporate Sustainability Reporting Directive (CSRD) and its core requirement, the Double Materiality Assessment (DMA), are more than just regulatory hurdles. They’re opportunities to reshape your business strategy and build long-term resilience. How can you move beyond compliance and truly master DMA?

“Double Materiality isn’t just about reporting; it’s about seeing your business through the lens of both impact and opportunity, driving resilience and long-term value.”

– Marc Roodhuyzen de Vries, CEO Nexio Projects

A robust Double Materiality Assessment (DMA) – identifying Impacts, Risks, and Opportunities (IROs) – is essential for effective CSRD reporting. Many organisations are finding it challenging to move beyond a superficial, tick-box approach. Nexio Projects offers practical strategies to transform your DMA into a tool for strategic advantage and sustainability leadership.

Rethinking double materiality

The DMA, as mandated by CSRD, assesses materiality through two lenses:

- Impact Materiality (Inside-Out): The effect of your company’s activities on people and the environment.

Example: Energy consumption leads to GHG emissions.

- Financial Materiality (Outside-In): How sustainability issues affect your company’s financial health.

Example: Carbon pricing policies impacting costs.

This ensures a holistic understanding of sustainability-related factors, driving informed decisions and reporting.

Why double materiality is more important than ever

Materiality has evolved from a reporting concept into a strategic tool for ESG performance. Understanding which sustainability topics genuinely matter to your business and stakeholders is essential, not just for compliance, but for focusing resources where they’ll have the greatest impact.

- Focused resource allocation: Understand which ESG topics warrant investment versus those less material to your context.

- Rating and assessment advantages: Leverage your materiality assessment for frameworks like EcoVadis, particularly with 2026 methodology changes allowing topic customisation.

- Strategic clarity: Move beyond generic ESG checklists to a sustainability strategy grounded in your actual impacts and risks.

Latest changes to CSRD: The Omnibus package

The EU Omnibus simplification package has reshaped CSRD scope whilst reinforcing the central role of double materiality.

CSRD now applies to EU entities exceeding 1,000 employees (up from 500) and EUR 450 million net turnover. Key changes include reduced data points by around 60%, focus on material topics, and limited mandatory value chain information requests.

What this means: For organisations outside CSRD scope, double materiality assessments remain valuable for voluntary ESG strategy. For those in scope, materiality-driven disclosure makes conducting a thorough double materiality assessment more important than ever—it determines which ESRS data points you’ll report.[1]

EcoVadis materiality customisation pilot

EcoVadis is continuing its materiality pilot in 2026 for organisations in pharmaceutical manufacturing, plastics production, electronics, machinery, data processing, and certain agricultural sectors.

Topics covered include water, air pollution, product use, product end of life, and customer health and safety. If a topic isn’t material, you can opt out and related questions will be deactivated.

To prove a topic isn’t material:

- Provide precise definitions and clear reasoning for exclusions

- Include supporting evidence (stakeholder interviews, peer benchmarking, or materiality thresholds)

Caution: EcoVadis will reactivate excluded topics if they detect contradictory information in your 360 Watch findings or documentation.

The advantage: Organisations with robust double materiality assessments can leverage this work for EcoVadis, creating efficiency and consistency across ESG disclosures.

Best practices to implement a robust DMA

Based on extensive experience supporting organizations in their sustainability journey, several key best practices have emerged for each phase of the DMA process.

Phase A: Understanding context

This initial phase is about setting the stage for the entire assessment. It involves developing a comprehensive understanding of your business, its value chain, and the broader environment in which it operates.

- Landscape: Inventory business model, inputs, outputs, and relevant external factors such as political, legal, environmental, social, and competitive elements.

Example: A food company needs to understand changing consumer preferences for organic products, potential impacts of climate change on supply chains, and new regulations regarding food waste.

- Value Chain: Map the value chain end-to-end, identifying key economic activities. As Vestas does, clearly map from extraction to end-of-life to identify affected stakeholders.

Example: A clothing brand maps from raw material sourcing (cotton farming), textile production, garment manufacturing, distribution, retail, and end-of-life (recycling, disposal) to understand where impacts and dependencies lie.

Example value chain by Vestas

Source: Vestas Annual Report

- Stakeholders: Identify and prioritize stakeholders for engagement.

This phase is crucial as it provides the foundation upon which the subsequent phases are built. A poorly defined context can lead to incomplete or inaccurate assessments later on.

Example: Stakeholders could include employees, customers, suppliers, investors, local communities, and NGOs.

Phase B: Identification of IROs

This phase focuses on identifying potential Impacts, Risks, and Opportunities related to sustainability across your value chain.

- Identify positive/negative and actual/potential impacts across the value chain.

Example: A positive impact could be a company’s investment in renewable energy reducing its carbon footprint. A negative impact could be deforestation caused by unsustainable sourcing of raw materials.

Best Practice: Identify impacts before identifying risks and opportunities because impacts inform most risks and opportunities. Specify the scope of IROs. Include the IRO title, followed by a description explaining the event, its cause, and consequence.

02. Identify risks and opportunities arising from these impacts.

Example: A risk could be increased operating costs due to carbon taxes. An opportunity could be developing innovative sustainable products that appeal to eco-conscious consumers.

The key is to be as comprehensive as possible, considering both current and future impacts, risks, and opportunities.

Phase C: Assessment and determination of material IROs

Here, the identified IROs are assessed based on pre-defined criteria to determine their materiality.

- Assess severity (scale, scope, irremediability) and likelihood of impacts.

Example: High severity could be irreversible damage to ecosystems, while high likelihood could be frequent disruptions to supply chains due to climate change.

- Assess magnitude and likelihood of risks and opportunities.

Example: High magnitude could be a significant loss of market share due to changing consumer preferences, while high likelihood could be increased regulatory scrutiny on environmental practices.

- Define materiality thresholds aligned with ESRS requirements and your ERM framework.

Example: Set specific thresholds for the amount of GHG emissions, waste generation, or water usage that would be considered material.

- Best Practice: Severity should take precedence over likelihood in cases of negative potential impacts on human rights.

Clear, well-defined materiality thresholds are essential for ensuring consistency and objectivity in the assessment process. The parameters contributing to severity should be assessed individually to better understand the justification.

Phase D: Disclosure

The final phase involves reporting on the DMA process, its outcomes, and material topics.

- Report on the DMA process, material topics, and relevant data points.

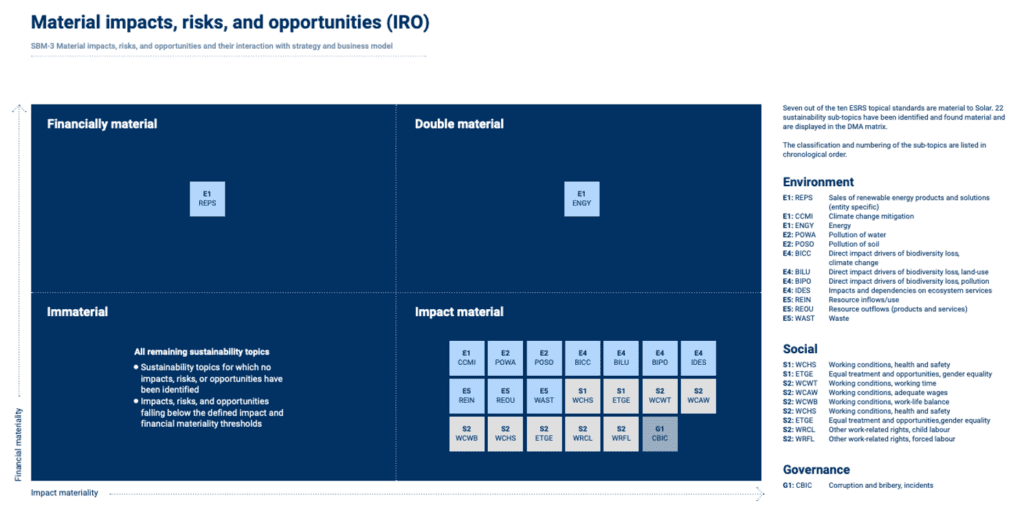

- Visually represent material topics. As demonstrated by Solar, clearly present the type of materiality rather than the level of materiality at a topic level.

Source: Solar Annual Report 2024

- Provide justifications for non-material topics.

Example: Explain why certain topics were deemed not material, referencing the assessment criteria and evidence considered.

This phase is about transparency and accountability. A well-structured and informative disclosure enhances stakeholder trust and confidence. It’s also essential to explain the thought process and decisions made during the DMA, providing context to the readers.

Navigating auditor scrutiny: Preparing for common questions

As companies gear up for CSRD reporting, it’s crucial to anticipate auditor scrutiny. Auditors will seek to understand the robustness and reliability of the DMA process. Expect auditors to delve into several key areas, requiring detailed documentation and clear justifications. Common questions include:

- What documentation was used in each step, from context setting to materiality determination? This includes meeting minutes, data sources, and methodological notes.

- What was the process to incorporate stakeholder views, and how did these views influence the assessment? Demonstrating genuine engagement and responsiveness is key.

- How were impacts for negative human rights treated, ensuring that severity took precedence over likelihood in the assessment?

- What were the justifications for making decisions and choices throughout the DMA, including stakeholder selection, threshold setting, exclusion of topics, and IRO assessment?

- Was there thorough mapping of dependencies, including any reliance on natural or social capital?

- Were the definitions of options in assessment parameters clearly defined and consistently applied?

- Were silent stakeholders considered, ensuring that the voices of potentially marginalised groups were taken into account?

By proactively addressing these questions and maintaining transparent documentation, companies can navigate auditor scrutiny with confidence.

Common pitfalls

Even organisations with strong sustainability teams can stumble during their first DMA. Here are the mistakes to avoid:

- Treating materiality as a one-off compliance task rather than an ongoing strategic process that evolves with your business

- Creating an ever-growing topic list instead of focusing on 10-12 truly significant issues clustered around clear strategic pillars

- Poor stakeholder engagement—either too narrow in scope or too broad without a structured approach leveraging existing networks

- Failing to define clear value chain boundaries, particularly regarding upstream supplier and downstream consumer responsibility

- Insufficient documentation of methodology and decisions, creating audit challenges later

- Lacking senior leadership involvement early, resulting in resource constraints and weak strategic integration

- Rushing into assessment without adequate context gathering about business activities, relationships, and external factors first

From compliance to competitive advantage

The DMA is a strategic asset, not just a compliance exercise. It enables you to:

- Inform strategy & decision-making: Understanding risks and opportunities helps prioritise initiatives.

- Develop resilience: Addressing value chain vulnerabilities builds a more robust business.

- Align with stakeholders: Engaging stakeholders enhances trust and loyalty.

How can we help?

At Nexio Projects, we are a global sustainability consultancy helping organisations move from compliance to meaningful impact. With over 1,000 projects delivered across 20+ countries, we support clients in navigating complex ESG frameworks and building reporting strategies that reflect both regulatory demands and business purpose.

Double materiality reporting sits at the heart of CSRD-aligned ESG reporting, but for many businesses, the process raises new challenges: How do you assess both the impact of the business on the environment and society, and the financial risks sustainability issues pose to your operations? Which topics matter most to your stakeholders, and how do you prioritise them?

Our team of ESG consultants and reporting experts work closely with clients to answer these questions and more, helping them establish a strong ESG foundation through robust double materiality assessments, clear documentation, and practical next steps. Whether you’re reporting for the first time or refining an existing strategy, we provide clarity and confidence every step of the way.

Learn from our clients like i-team Global and LC Packaging how we assist with reporting, DMAs and more.

Subscribe to our newsletter to see more on DMA best practices, as well as key updates regarding the Omnibus proposal.

Ready to transform your CSRD compliance into a strategic advantage? Check out our ESG reporting services and see what we can offer for your organisation. Request a free consultation to discover how Nexio Projects can support your sustainability journey.