How to prepare for a Double Materiality Assessment under the CSRD?

How to prepare for a Double Materiality Assessment under the CSRD?

“Carbon accounting turns climate ambition into numbers your business can manage, track and act on.”

For businesses, decarbonisation is no longer a side project; it is rapidly becoming a basic licence to operate. Customers, investors and regulators increasingly expect companies to understand their climate impact, disclose their emissions and show how they plan to reduce them over time. At the same time, energy prices, supply‑chain risks and innovation pressures are pushing organisations to rethink how they create value in a lower‑carbon economy.

In Nexio Projects’ Decarbonisation 101 series, the aim is to demystify this journey and break it down into clear, practical steps that any company can follow. We use a simple five‑stage framework: Baseline, Vision, Plan, Execute and Engage — to guide organisations from first measurements to long‑term partnerships and impact. The first step in this journey is the baseline, understanding where emissions come from today so that every decision on strategy, investment and operations is informed by solid evidence. This is where carbon accounting comes in and where achieving net zero truly starts.

Carbon accounting in a nutshell

Carbon accounting is the process of measuring, analysing and reporting an organisation’s greenhouse gas emissions in a structured, repeatable way. In practice, it works like a carbon ledger that sits alongside financial accounts and allows meaningful carbon footprint measurement over time.

Done well, carbon accounting helps to:

- Reveal which activities, sites and suppliers drive the majority of emissions

- Improve data management, needed to ensure GHG Protocol alignment

- Track progress against climate targets year on year

- Provide a shared language for internal and external climate discussions

By translating everyday activities such as fuel use, electricity consumption and purchasing into emissions data, carbon accounting underpins credible net‑zero and transition plans. It also provides the foundation for demonstrating transparent carbon reduction to regulators, customers and investors.

The rules of the game: Standards and frameworks

To avoid everyone “doing their own maths”, most leading companies use the Greenhouse Gas (GHG) Protocol as the reference standard for corporate carbon accounting. This global framework sets common rules for what to measure, how to classify emissions and how to report them consistently across sectors and geographies.

The GHG Protocol also connects corporate practice to the wider disclosure landscape. It is referenced by the Science Based Target Initiative and underpins climate‑reporting rules such as CSRD in the EU and emerging regulations in the US. Aligning with these standards ensures that the question of ‘how to measure carbon emissions’ internally also meets external expectations from regulators, investors and peers.

Understanding emissions scopes

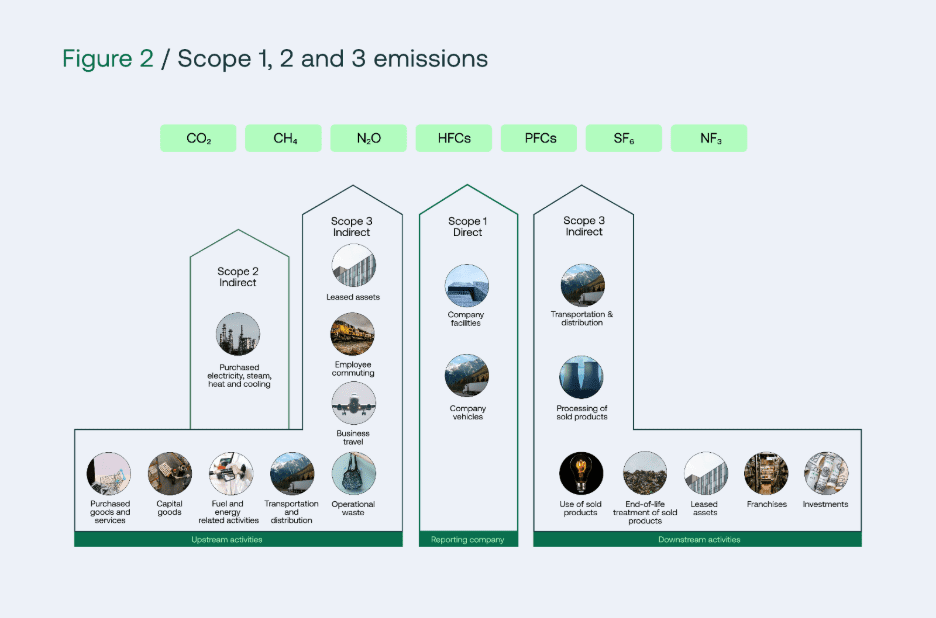

A central idea in the GHG Protocol is the division of emissions into three scopes, which helps organisations distinguish between direct and indirect impacts. Scope 1 covers direct emissions from sources the company owns or controls, Scope 2 covers purchased electricity, heat, steam and cooling, and Scope 3 includes all other relevant value‑chain emissions.

This structure matters because it prevents double counting between different actors in a supply chain and clarifies who is responsible for which sources. It also makes it easier to prioritise carbon accounting actions that lie within direct control versus those that require collaboration with suppliers, customers or partners.

Deep dive: Scope 3 and value‑chain emissions

Once the basics of Scopes 1 and 2 are in place, most organisations discover that the real story lies in Scope 3. These emissions are grouped into 15 categories, covering everything from purchased goods and services to investments, and they capture the broader impact of how a company buys, operates and sells. For a manufacturer, this might include raw materials, capital goods, inbound logistics and product use; for a service provider, it could centre on cloud services, travel and leased assets.

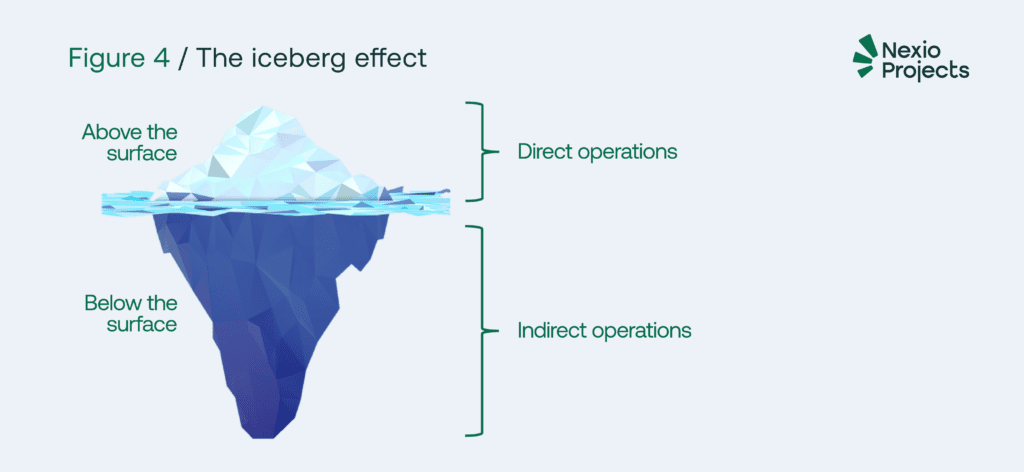

We often use the image of an iceberg to describe Scope 3: the visible part above the waterline represents Scopes 1 and 2, while the much larger mass below represents the value‑chain impact. In many sectors, Scope 3 can account for the majority of total emissions, which means any serious decarbonisation strategy must look beyond direct operations and into supplier and customer relationships.

Looking at Scope 3 through this lens highlights several strategic opportunities for businesses:

- Measuring Scope 3 emissions helps organisations clearly identify “hotspots” across their value chains, revealing where the largest carbon impacts are concentrated.

- This visibility enables companies to prioritise high-impact actions and focus resources where they can deliver the greatest emissions reductions.

- Working closely with key suppliers creates opportunities to co-develop low-carbon materials, processes, and technologies that are both scalable and commercially viable.

- Strong supplier collaboration supports greater supply chain transparency and builds shared accountability for climate targets.

- Over time, these partnerships can evolve into more resilient, long-term relationships that reduce operational risk and improve business continuity.

This approach is reflected in Nexio Projects’ focus on proactive supplier engagement and net-zero-oriented collaborations, helping align business objectives with sustainability outcomes.

Watch our on-demand session about the hidden supply chain emissions to learn more about Scope 3.

Key concepts: From activity data to CO2e

Behind every emissions figure are two core ingredients: activity data and emission factors. Activity data describes “how much” of something has happened—kilograms of plastics purchased, tonne‑kilometres of freight moved, litres of fuel consumed, kilometres travelled, or tonnes of waste sent to landfill. Emission factors express the “per‑unit” impact, such as emissions per kWh of electricity, per kilometre travelled or per kilogram of material.

The basic calculation is straightforward:

- Activity data = the quantity of an activity (for example, electricity used)

- Emission factor = emissions per unit of that activity

- Result = activity data × emission factor = estimated emissions

Because different greenhouse gases warm the atmosphere by different amounts, results are converted into carbon dioxide equivalents (CO2e) using global warming potentials. This allows organisations to look at a single, comparable metric when they consider carbon management and manage them over time.

Business benefits of robust carbon accounting

Although the initial motivation is often regulatory or reputational, organisations that invest in strong carbon accounting usually discover tangible business value. High‑quality data prepares them for tightening disclosure rules and investor scrutiny, while enabling clearer conversations with stakeholders who expect honest, comparable information on climate performance.

From a practical perspective, a robust baseline can:

- Highlight quick‑win efficiency projects that reduce costs and emissions

- Support smarter procurement and supplier engagement decisions

- Strengthen brand and employer reputation with climate‑conscious audiences

In this way, carbon accounting becomes a strategic tool rather than an administrative burden, helping to identify where carbon reduction aligns with operational resilience and innovation.

FAQ

How often should a company update its carbon inventory?

Most companies update their carbon inventory annually so it aligns with their financial or calendar year and external reporting cycles. More advanced organisations may also track key indicators quarterly to spot trends, refine their decarbonisation strategy and prepare for more frequent disclosure requirements.

Do small and medium‑sized enterprises really need carbon accounting?

Yes, SMEs increasingly face expectations from larger customers, lenders and regulators to understand and disclose their emissions. Having even a simple baseline helps smaller businesses stay competitive in supply chains, identify cost‑saving efficiency measures and prepare for future reporting rules without last‑minute stress.

What data quality is “good enough” to get started?

Early inventories often combine precise activity data in some areas with more estimated or spend‑based figures in others, and that is acceptable as a starting point. The key is to document assumptions clearly, prioritise the biggest emission sources first and commit to improving data quality year on year as systems and supplier engagement mature.

How does carbon accounting link to target setting?

Carbon accounting provides the baseline and ongoing tracking needed to set and monitor climate targets, including those aligned with the Science Based Target Initiative. Without robust data on current emissions and trends, it is difficult to choose realistic goals, identify the right levers for carbon reduction or demonstrate progress to stakeholders.

First steps for companies starting out

For organisations at the beginning of their journey, the main challenge is often knowing where to start. The most effective approach is usually to begin with clarity on boundaries: which entities, sites and activities fall inside the carbon inventory, and which lie outside.

Once this is defined, the focus can shift to identifying major emission sources and gathering the best available data from finance, operations and procurement teams. From there, companies can choose suitable emission‑factor sources, run initial calculations to create a high‑level baseline, and use that insight to prioritise where deeper analysis and targeted carbon accounting efforts will add the most value.

As a pure‑play sustainability consultancy, Nexio Projects supports this process with a team of specialists in carbon footprint assessment, data management, science‑based target setting, decarbonisation and full climate transformation. Working closely with clients, the team designs tailored approaches that reflect sector‑specific realities, data maturity and ambition levels, from first screenings through to detailed roadmaps and implementation support.

Organisations interested in structured, hands‑on guidance should contact us to get in touch with our net zero consultants.

You can subscribe to our monthly newsletter to receive regular climate news, regulatory updates, tips and best practices for the way to net zero.