Mastering Scope 3 for chemical sector: Upstream emissions

Mastering Scope 3 for chemical sector: Upstream emissions

The European Parliament has recently taken a plenary vote on the Omnibus proposal, marking a critical juncture in the evolution of sustainability regulation within the EU. In our recent webinar, we unpacked the key implications of this legislative development as well as of the broader Omnibus simplification package for businesses navigating the Corporate Sustainability Reporting Directive (CSRD). This article distils those insights and highlights what organisations need to know going forward as the Omnibus reshapes reporting obligations, timelines, and compliance strategies.

Legislative process so far

What happened?

The European Commission’s Omnibus package proposed in early 2025 addresses complexity and burden overload within CSRD, CSDDD, EU Taxonomy, and CBAM. It introduces significant amendments including increased thresholds for reporting, timeline deferrals, and datapoint reduction. .

Why?

The sustainability Omnibus package aims to reduce administrative burden for all businesses and to boost the EU’s competitiveness and growth.

Who will be impacted?

Both companies that remain in scope of the CSRD and CSDDD, as well as companies that might fall outside the scope are likely to be impacted by the Omnibus package. Either having to comply with the new regulations or by needing to adapt to new strategic considerations, businesses across the the EU and those that operate across jurisdictions will need to stay up-to-date with regulatory developments.

The EU Commission’s Omnibus simplification package proposal

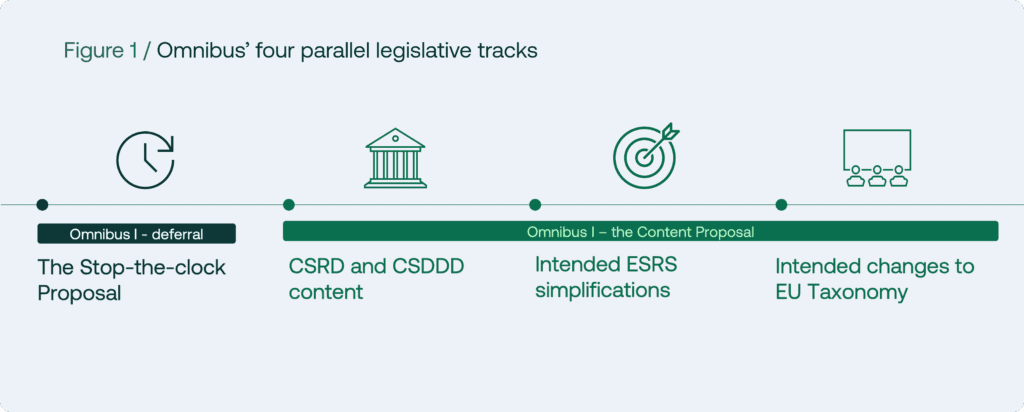

The EU Comission’s proposal in February 2025 includesd four parallel legislative tracks:

The Stop-the-clock proposal

The Omnibus Directive implements a “stop-the-clock” approach, granting a two-year deferral on the application of CSDDD, as well as CSRD reporting deadlines for waves 2 and 3 companies,. This pause is meant to allow enough time for additional content-related developments to be adopted.

CSRD and CSDDD content changes

- Reporting thresholds (employee count and financial turnover) are increased, narrowing the scope of obliged companies under both CSRD and CSDDD.

- Data collection from value chain actors is to belimited to entities in scope;The obligation to adopt climate transition plans aligned with the Paris Agreement is removed; disclosure is required only if plans exist.

Intended ESRS simplifications

- The Omnibus package announced a major reduction (over 60%) of ESRS datapoints and further simplifications of the ESRS architecture

- Sector-specific ESRS standards are no longer mandatory but might become available as voluntary guidance.

- Assurance remains limited, avoiding the complexity and cost of immediate transition to reasonable assurance standards.

- While the Revised ESRS Exposure Draft became available this summer, EFRAG is expected to release its official proposal for a simplified ESRS in December this year.

Intended changes to EU Taxonomy

- EU Taxonomy scope and application thresholds are to be aligned with revised CSRD requirements.

- Simplified “Do No Significant Harm” (DNSH) criteria and KPI templates ease compliance.

- Financial materiality thresholds applied to exempt non-material economic activities from eligibility and alignment assessments.

Zooming in on the Omnibus Content Proposal and changes proposed by the European Parliament

The most recent changes according to the European Parliament’s vote include:

- Increased thresholds for reporting – CSRD threshold is moved to 1,750 employees and 450 million EUR turnover, while CSDDD reporting thresholds are raised to 5,000 employees and 1.5 billion EUR turnover.

- Removal of mandatory climate transition plans under the CSDDD. Under the CSRD, climate transition plans are to be disclosed if in place, however the obligation to implement such plans has been removed.

- Under CSDDD, the Parliement has removed provisions related to a harmonised EU-level civil liability regime, without no option to revisit this provision in the future.

For further implications of these changes, watch our on-demand session.

Next steps

The European Parliament will enter trilogue negotiations with the Council and the Commission to agree on a final position regarding the sustainability Omnibus package in late 2025

How should businesses respond?

For companies in scope

An immediate start on updating double materiality assessments is advised. Companies should identify any potential gaps and prioritise relevant ESG datapoints within the newly streamlined list, establish or refine sustainability governance and operational data systems, and ready themselves for external assurance requirements ahead of 2027 reporting.

For companies not in scope

Preparation involves benchmarking competitor disclosures, engaging internal and external stakeholders to understand expectations, prioritising action plans aligned with business strategy, and monitoring evolving regulatory landscapes for future alignment opportunities.

Download our reporting guide to get a clearer view on the existing ESG reporting frameworks!

Live Q&A

Will my company be in scope if we recently acquired a UK subsidiary pushing employee numbers above 1,750?

Yes. Consolidated employee numbers across the group count towards thresholds, triggering CSRD requirements if thresholds are met for Fiscal Year 2027.

Which documents should we follow to stay updated on Omnibus and ESRS requirements?

The final Omnibus legal text post-trilogue and the revised ESRS Exposure Draft expected on December 4, 2025, will provide additional guidance.

How do I calculate employees for thresholds?

Refer to the definition of employees and calculate full-time equivalents including temporary and contract workers according to the legislation specific to each EU member state.

Are climate transition plans still mandatory?

The Omnibus removes the mandatory adoption of climate transition plans; companies must disclose if such plans exist but are not required to implement them.

What options do companies have if they are not yet in scope?

They should map stakeholder expectations, assess regulatory readiness, prioritise ESG initiatives as per their sustainability strategy, and maintain flexibility to adopt voluntary frameworks.

What is the ESRS and CSRD timeline for compliance?

Wave 1 (Large PIEs) entities report for FY2024 in 2025;

Wave 2 (large companies and groups – thresholds TBD as per final Omnibus Content Propodal) for FY2027 (reporting in 2028);

Wave 3 (listed SMEs) for FY2028.

How will the reporting datapoints be reduced?

The Omnibus proposes reducing mandatory datapoints by over 60% to approximately 400. More information will become available in December 2025, with EFRAG’s Revised ESRS proposalHow should mergers and acquisitions affect compliance?

Reporting thresholds reflect consolidated numbers, so companies should investigate thresholds internally together with their legal teams and/or auditors.

How can voluntary sustainability reporting standards be leveraged for companies not in scope of the CSRD??

Entities outside the CSRD scope may choose to report under voluntary frameworks such as GRI, VSME, IFRS S1 and S2 to meet stakeholder demands.

How should companies approach DMA updates?

Update DMAs regularly to reflect significant organisational or business model changes, using flexible, proportionate approaches aligning with the revised ESRS.

Start preparing now with Nexio Projects

The key takeaway is that the EU Green Deal’s Net Zero remains the ultimate goal for businesses worldwide, and the imperative to prepare and act now has never been stronger. Despite the evolving regulatory landscape and ongoing adjustments to frameworks , one truth stands firm: ESG is here to stay and will continue shaping corporate strategy and operations.

This is precisely where Nexio Projects steps in: offering trusted, expert guidance to simplify complex ESG challenges and help organisations transform compliance requirements into purpose-driven leadership. Nexio Projects is a leading sustainability consultancy trusted worldwide to simplify complex ESG challenges. Named among the top 10 boutique sustainability firms globally, we support organisations in various ESG reporting services such as CSRD compliance, ESRS implementation, double materiality assessments, and strategic ESG integration, from compliance foundations to purpose-led leadership.

Contact us today for a free consultation or subscribe to our ESG newsletter featuring sector insights, latest regulatory updates, and best practices.