Scope 3 emissions: Measurement & reduction strategies

Scope 3 emissions: Measurement & reduction strategies

“Environmental risk management directly translates to financial returns. CDP helps you tackle environmental data transparently and take action.”

Why environmental data matters more than ever

Environmental data has become essential for financial risk management. According to CDP, £38 trillion from the global economy could be lost if environmental risks aren’t acted upon. The European Union’s agricultural sector alone already loses €28 billion each year due to environmental impacts. These aren’t distant threats – they’re present realities shaping business decisions today.

The numbers speak for themselves. In CDP’s 2024 assessment, 67% of disclosing companies identified environmental risks with substantive financial effects. Across climate, forests and water, the estimated impact of these risks totals trillions. Yet the cost to mitigate remains significantly lower than bearing the risks themselves.

This is why the CDP framework continues to gain momentum. In 2025, over 22,000 companies responded to CDP disclosure requests, representing nearly two-thirds of global market capitalisation. Perhaps most telling: 4,400 companies disclosed for the first time, signalling that the benefits of CDP as a platform for climate reporting continue to grow.

Source: CDP

Understanding the CDP timeline

The CDP reporting cycle follows a predictable schedule, and knowing these key dates helps you plan effectively:

- March/April: Portal opens for requesters, scoring methodology published

- Week of 20 April: Questionnaire and guidance published

- Week of 15 June: Response window opens for corporates

- Week of 14 September: Scoring deadline

- Week of 26 October: Unscored responses deadline

- Week of 30 November: Scores published and available to disclosers

Critical advice: Submit at least one week before the 14 September deadline. Every year, platform strain on the final day causes crashes. Companies relying on last-minute submissions risk technical issues affecting their ability to submit on time.

Key changes for the 2026 questionnaire

The 2026 CDP questionnaire brings six notable updates designed to strengthen environmental disclosure and broaden the scope of reporting. These changes reflect CDP’s commitment to comprehensive environmental impact disclosure whilst maintaining alignment with evolving global standards.

- Ocean disclosure: New addition to CDP’s framework; optional and unscored for the first reporting cycle in 2026

- Scoring and scope: New questions added across the forests and water modules with an increased scope of reporting for plastics

- SBT for Nature: Companies with a Science Based Target for Nature can now be recognised within leadership level scoring

- Adaptation and resilience: Expanding of existing questions on how organisations are preparing for environmental risks

- Opportunities for SMEs: Small and medium enterprises are now eligible to receive a score of A

- Alignment with frameworks: CDP has strengthened their alignment with various standards, particularly with Taskforce on Nature-related Financial Disclosure (TNFD)

Ocean disclosure: The most visible addition

The introduction of ocean disclosure represents the most visible change to the 2026 CDP reporting framework. This responds to increased market demand for reporting on ocean-related data, with financial institutions like BNP Paribas publicly encouraging companies to make this information available.

The ocean module will be:

- Integrated into existing modules rather than standing alone

- Optional but encouraged, especially for high-impact sectors

- Unscored for the first reporting cycle in 2026

- Aligned with frameworks including TNFD, SBTN, ESRS and UNGC

Whilst the full question bank isn’t yet released, expect questions on key dependencies and impacts on marine ecosystems, priority locations in your value chain vulnerable to ocean-related risks, and targets for reducing environmental pressures on oceans. Companies with material ocean-related dependencies, impacts, risks and opportunities – such as seafood, shipping, coastal tourism, marine renewable energy etc. – are particularly encouraged to opt in.

Scoring and scope changes across modules

For climate disclosure, the good news is stability. No major changes affect the climate questionnaire in 2026. Companies can expect similar questions to 2025, with minor phrasing updates for clarity.

Forests security reporting sees significant expansion:

- Scoring now includes cocoa, coffee and rubber products

- These join the existing scored commodities: palm oil, soy, timber and cattle

- Five years after their introduction, these commodities now carry scoring weight

- Changes expected to no-deforestation and no-conversion target reporting

Water security reporting introduces more stringent requirements. CDP now accepts Science Based Targets for Nature for freshwater quantity and quality, alongside more detailed questions on wastewater treatment levels before discharge. Additional detail is required on pollutant measurement success, and companies must explain if they’re not currently measuring discharge pollutants.

The plastics module remains unscored but adds new questions on plastics-related targets, metrics on packaging formats used across product portfolios, data on packaging designed for recycling and composting, and volume of products sold through reuse models.

SME opportunities

Small and medium enterprises receive welcome news: they’re now eligible for A-level scores. Previously capped at B, this change recognises that environmental leadership isn’t determined by company size. SMEs with robust environmental management can now achieve the same recognition as larger corporations.

Adaptation and resilience

CDP expands existing questions on how organisations prepare for environmental risks. This update gives companies options to disclose adaptation measures throughout their operations in greater detail, with adjusted scoring to incentivise and reward comprehensive adaptation strategies.

Interested in diving deeper into the changes and what they mean at this stage? Watch the session on demand!

Framework alignment

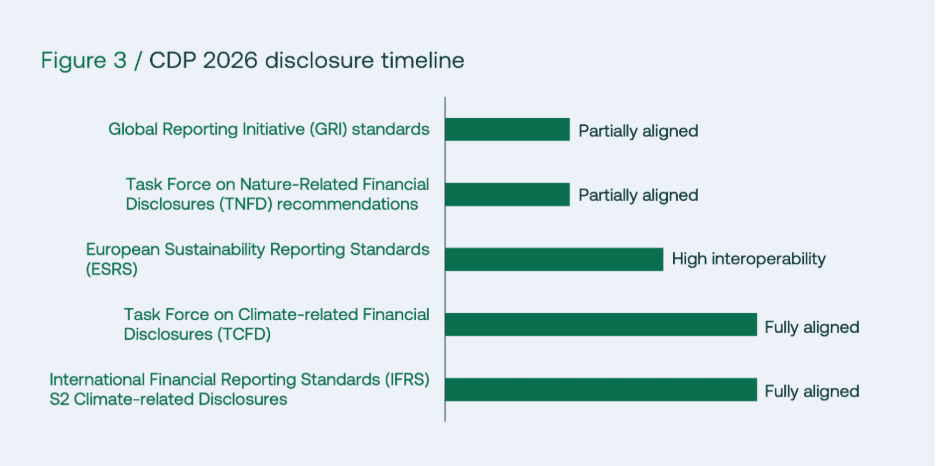

One of the most significant ongoing developments is CDP’s strengthening alignment with major standards and frameworks. This interoperability reduces reporting burden by allowing companies to prepare data once and use it across multiple climate reporting requirements.

Current alignment levels:

- TCFD and IFRS S2: Fully aligned – IFRS S2, which integrates and expands upon TCFD’s 11 core recommendations is foundational to the CDP climate questionnaire

- ESRS E1: High interoperability – approximately 75% of ESRS E1 disclosure requirements align with CDP

- TNFD: Partially aligned – approximately 35% fully integrated, 42% partially integrated

- GRI Standards: Partially aligned – CDP partially integrates GRI’s 102 (Climate Change) 103 (Energy), 303 (Water & Effluents), and 101 (Biodiversity) Standards

For CSRD-obligated companies, this alignment is particularly valuable. Your CDP disclosure supports ESRS E1 compliance across climate risks, GHG emissions, transition plans, economic activities and governance – reversely, ESRS E1 compliance means much of CDP-requested content is readily available

Expert Q&A

Why is achieving an A-level score so challenging?

CDP’s scoring methodology remains highly complex, and predicting scores is difficult because score thresholds can change year-on-year, redistributing companies between scoring bands based on overall performance. The essential criteria present the biggest challenge. Despite strong performance across governance, strategies or reporting, reaching A level remains difficult without meeting specific criteria, for example for Climate (non-exhaustive)

- A publicly available 1.5°C-aligned transition plan

- Monetary incentives at board / executive level for management of climate issues

- A complete emissions inventory with no material exclusions

- Third-party verification of 100% of Scope 1 and 2 emissions

- Third-party verification of at least 70% of at least one Scope 3 category

Missing even one essential A-list criterion caps your score at A-, misisng even one Leadership criterion caps your score at B and so on, regardless of how well you perform elsewhere.

Does a 1.5-degree transition plan require SBTI alignment?

Science Based Targets Initiative validation covers the target component, but a complete transition plan requires substantially more. CDP’s guidance defines a 1.5-degree transition plan as including validated targets with science-based emissions reduction targets aligned with 1.5°C, but that’s just the starting point.

You’ll also need a detailed action plan specifying measures to address emissions across scopes, financial mapping showing investment requirements tied to specific actions, and governance integration demonstrating upper management involvement and responsibility. Most importantly, the plan must show strategic embedding with evidence that climate action is core to business strategy, not merely aspirational. The plan must demonstrate that climate action is genuinely integrated into your operations and decision-making.

What practical steps should first-time disclosers take?

Don’t underestimate the reporting burden. CDP largely remains an ad hoc exercise requiring significant data collection efforts and resources. Companies often have elements in place to address CDP questions but not to the level of detail requested. Starting early is essential:

- Review last year’s questionnaire to understand data requirements

- Identify key stakeholders across departments who hold necessary data

- Account for summer timing – key personnel may be on leave

- Build relationships early with data owners to avoid delays

- Start data collection as soon as the questionnaire publishes in April

This preparation helps identify gaps between what you have and what CDP expects.

Are water and forests modules scored?

Yes, both water security reporting and forests security reporting receive scores, just like climate. However, you may not be required to respond to these modules. Three scenarios exist:

- Capital Markets signatories request that you report on Water / Forests: You will get scored (and receive an F if you decline the request) and that score will be public.

- The request comes from a supply chain requester: Your score will be shared with requesters but remain private, unless you score an A.

- CDP’s sector classification determines Water / Forests is a material topic for your organisation: You may opt out of responding, and this will remain private.

Currently, only plastics and biodiversity (and Ocean starting this year) modules remain unscored, though this could change in future cycles as these frameworks mature.

Is a public response a requirement for an A score?

Submitting a public response is mandatory at the Leadership level (A-). Companies that do not make their response public will be capped at a B score. Therefore, publishing a public response is required not only to achieve an A (A-List) score, but also to attain an A- level.

No-regret actions you can take now

Prepare for GHG Protocol land sector guidance

Although companies aren’t expected to report quantitative data aligned with the GHG Protocol’s new Land Sector and Removals Standard in 2026, CDP will integrate it from 2027 onwards. If this guidance is relevant to your operations – particularly if you have agricultural activities or land-related emissions – start adopting it now. The first year implementing new guidance always presents friction. Starting early gives you time to refine your processes.

Create cross-disclosure alignment

CDP shouldn’t exist as an isolated exercise. Create internal alignment across disclosures:

- Identify relevant standards: TCFD, IFRS, GRI, SBTN, TNFD – which apply to your geography and industry

- Engage key teams early: Finance and legal teams often hold crucial data

- Build a cross-disclosure appendix: Group topics and prioritise actions across standards

- Prepare data once: Use alignment to reduce burden rather than treating each framework separately

This strategic approach transforms CDP from an annual burden into part of an integrated environmental impact disclosure strategy.

How Nexio Projects supports your CDP journey

Whether you need full support or targeted guidance, we offer solutions across the disclosure journey.

- CDP assessment completion: We provide outsourced completion where we manage the entire process – from stakeholder engagement and data collection to drafting and submitting the questionnaire on your behalf.

- CDP assessment review: We review your current draft as you build it, flagging gaps and identifying quick wins against CDP expectations and relevant frameworks to maximise your score.

- CDP gap analysis: We examine your previous submission to pinpoint what limited your score and where evidence or detail was missing, providing a clear, prioritised improvement roadmap for the next cycle.

Strong CDP support requires robust underlying data. We also help you with:

- Carbon Footprint Assessment: We calculate Scope 1, 2 and 3 emissions, building robust baselines, identifying hotspots and turning findings into practical reduction actions

- Climate Risk Assessment: We report your organisation’s climate risks with TCFD-aligned regulatory compliance, tailored to your specific business context

Your climate partner

At Nexio Projects, we support clients across more than 20 countries in over 25 sectors, including shipping and logistics, manufacturing, chemicals, consumer goods, packaging, and more.

With 50+ experts from 25 nationalities spread across four continents and speaking over 10 languages, we’ve guided 400+ clients across 1,000+ projects on their sustainability journeys. Our integrated approach covers ratings and certifications such as EcoVadis and B Corp, climate change, ESG strategy, and CSRD and reporting compliance.

We bring clarity from climate impacts to supply chain challenges. Our team helps you navigate the complex landscape of environmental disclosure, turning reporting obligations into strategic opportunities.

Ready to prepare for CDP 2026? Book a free consultation with our climate experts. We’ll discuss your specific situation and identify how our CDP support can help you navigate the upcoming disclosure season successfully.

If you’re interested to see more climate updates, trends and best practices, sign up to our newsletter.

Useful resources

Mastering CDP’s essential criteria: How to secure a stronger score in 2025

This article dives deep into the Essential Criteria for CDP submissions, gap analysis, sector-specific tailoring, third-party verification requirements, and board oversight. It provides actionable steps to avoid surprises and achieve leadership-level scores.

Navigating the CDP 2025 disclosure cycle: Updates, timelines, and tips

Comprehensive overview of the 2025 CDP questionnaire changes, minor but meaningful adjustments, timelines, and practical tips to ensure your reporting remains credible and future-ready.

Building a climate-resilient ESG strategy for 2025

Covers key steps to embed climate risk assessment and monitoring into your ESG strategy aligned with CDP expectations and broader regulatory demands.

Using CDP as a tool to report on ESG strategy

Insights on leveraging CDP to demonstrate your commitment to sustainable business and to align disclosures with evolving stakeholder expectations.

CDP: How to improve my score

Held on 11 February 2025, this webinar covers CDP criteria essentials, common pitfalls, major updates impacting scoring, and practical strategies for newcomers and experienced reporters. A Q&A segment covers topics such as taxonomy disclosures, data collection software, and CDP-SBTi alignment.

Understanding CDP’s new integrated format

Explores the 2025 streamlined questionnaire format and best practices to navigate it efficiently, including verification, scoring methodology, and software solution recommendations.

Stakeholder mapping for effective decarbonisation

Focuses on how to engage internal and external stakeholders effectively during your decarbonisation journey, supporting your CDP climate risk and opportunity disclosures.

Master climate risk: Your path to global compliance

Upcoming on 9 October 2025, this webinar will equip you to manage climate risks within the framework of CDP, TCFD, ISSB, and CSRD, critical for comprehensive climate reporting.