The art of collaboration: Supplier engagement

The art of collaboration: Supplier engagement

With the final European Sustainability Reporting Standards (ESRS) approved and applicable from January 1, 2024, many organisations are now required to start collecting data to fulfil the Corporate Sustainability Reporting Directive (CSRD) in their next non-financial reports.

CSRD is a legislative proposal adopted by the European Commission which obligates companies under scope to report in compliance with ESRS. The CSRD uses the ESRS framework to structure and set the disclosure requirements that need to be met. Organisations must include ESRS requirements in their non-financial reporting.

What companies need to report for CSRD?

Companies within the European Union (EU)

EU publicly listed and large companies (or subsidiaries) as well as large companies that meet at least 2 out of the 3 criteria:

- €50M+ Revenue

- €25M+ Balance Sheet

- 250+ FTE

This is adjusted from €40M+ Revenue and €20M+ Balance Sheet in the final version of the ESRS Standard June 2023. The criterion for FTEs remains unchanged.

Companies from outside the EU

- Companies with securities, such as stocks or bonds, listed on a regulated market in the EU

- Companies with annual EU revenues exceeding €150 million and an EU branch with net revenue of more than €40 million

- Companies with annual EU revenues exceeding €150 million and an EU subsidiary that is a large company, defined as meeting at least 2 of the following 3 criteria: more than 250 EU-based employees, a balance sheet above €20 million or local revenue of more than €40 million.

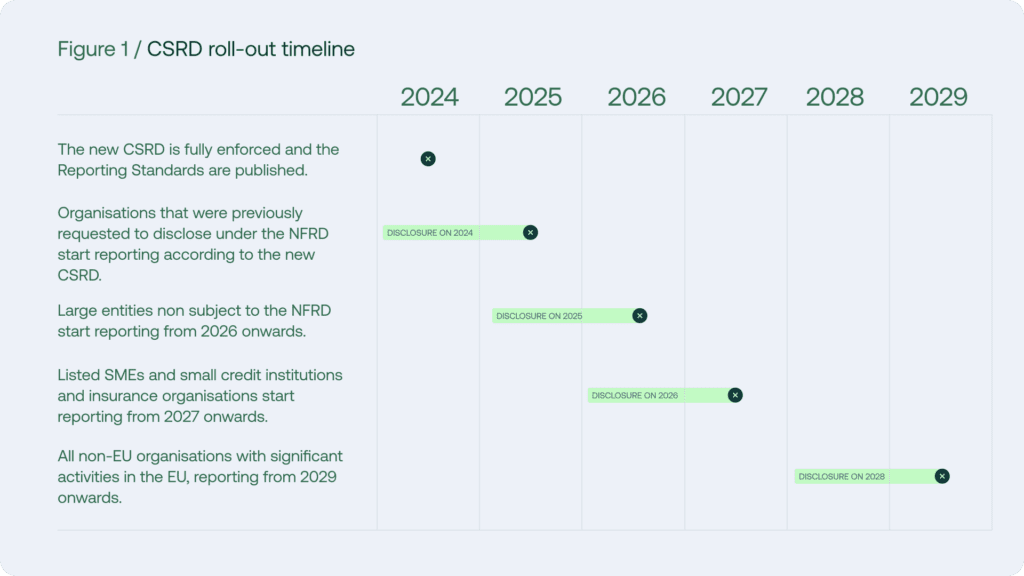

What is the timeline for CSRD?

What to disclose according to CSRD?

While there have been a lot of conversations around CSRD, what really needs to be understood is the European Sustainability Reporting Standards (ESRS). A good frame of reference is the GRI Standards because GRI served as a basis and played a large role in the development of the ESRS. The overarching ESRS framework can be categorised into the following:

Cross-cutting standards

This is like the GRI Universal Standards which contains general disclosure requirements. It comprises ESRS 1 & 2 which are now available for use.

Sector Agnostic standards

These standards affect various companies irrespective of sector. Similar to the GRI Topic Standards.

Sector-specific standards

Describe disclosure requirements that are specific to each different sector. These are still in progress and are expected in June 2024.

How to prepare for CSRD?

To help organisations better understand what is needed to prepare for CSRD, we have developed an ABCD approach so sustainability, ESG and CSR professionals can visualise what is required:

A / Analyse

The initial step towards CSRD compliance involves a thorough analysis. Conducting a Double-Materiality Assessment is mandatory under ESRS 2 to identify relevant Topical ESRS Standards applicable to your company. This phase includes a gap analysis of current sustainability/ESG reporting and management systems to gauge compliance levels and identify areas that need attention.

B / Build

In the second phase, building governance and reporting structures becomes crucial for effective sustainability/compliance management. Establishing a clear reporting framework, manual, and baseline of KPIs is essential. Governance structures, roles, responsibilities, internal processes, controls, and monitoring systems should be set up, along with the adoption of policies formalising the company’s sustainability commitments.

C / Consolidate

Phase 3 focuses on consolidating various elements required by ESRS for reporting. This includes describing the company’s strategy and business model in relation to impacts, risks, and opportunities defined as material. Clear goals, targets, action roadmaps, and in-depth risk assessments are developed, aligning with the sustainability strategy. Phases B and C are interdependent and iterative, with results from consolidation needed to complete policies from the building phase.

D / Disclose

The final phase involves integrating all qualitative and quantitative disclosure statements into the non-financial section of the Management Report. This report, combined with yearly financial reporting, should be digitally tagged for machine readability. External assurance is obtained, and considerations for additional communication methods, such as (bi-)annual sustainability reports or extensive webpages, are made to engage internal and external stakeholders effectively.

Summary